AvalonBay Communities Inc

Latest AvalonBay Communities Inc News and Updates

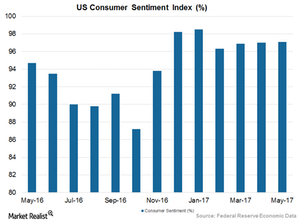

Could Rising Consumer Sentiment Boost REITs Like AVB?

According to the University of Michigan, the consumer sentiment index for May 2017 gained 2.5% year-over-year, standing at 97.1%.

The Impact of Trump’s Proposed 2018 Budget on Residential REITs

According to President Trump’s proposed budget for fiscal 2018, the administration is expected to slash $6 million from the U.S. Department of Housing and Urban Development budget, decreasing its funding by 13.2% to $40.7 billion.

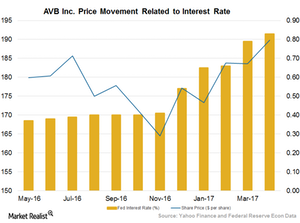

How Rising Interest Rates Impact AVB and Residential REITs

There is wide anticipation in the market that the Federal Reserve could raise interest rates again during its upcoming meeting on June 14, 2017.

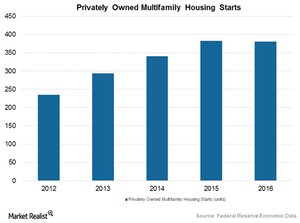

AvalonBay Communities and the Residential REIT Industry Overview

According to NHAB’s Housing Economics survey, housing starts are expected to rise 6.2% in 2017 and ~6.3% in 2018, backed by respective 9.6% and ~11.8% gains in single-family home sales.

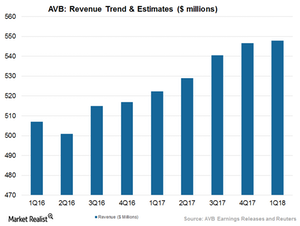

AvalonBay Maintains Revenue Growth amid Industrial Headwinds

AvalonBay’s 1Q17 revenues came in at ~$522.3 million and surpassed estimates by 0.3%.

AvalonBay: Weathering Ups and Downs in Residential REITs

In May 2017, 11 of 23 analysts covering AvalonBay Communities (AVB) stock issued “buy” or “strong buy” ratings. Eleven analysts gave AVB a “hold” rating, and one analyst gave it a “sell” or a “strong sell” rating.

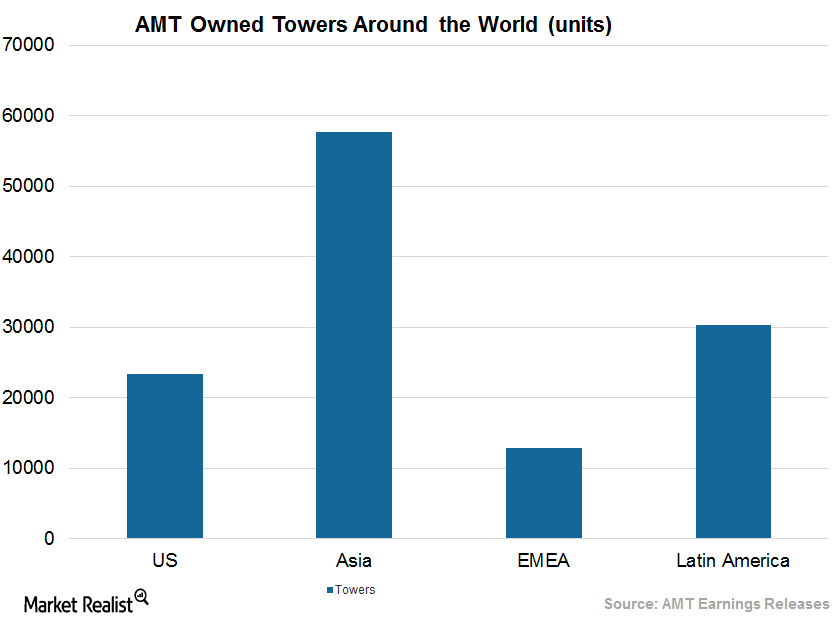

American Tower’s Business Model Seeks Consistent Profitability

AMT maintains non-cancellable long-term leases with an initial term of ten years. Almost 50% of the company’s leases have a renewal date of 2022 or beyond.

How Zoning Regulations Benefit Communities

Zoning protects existing property values by preventing incompatible uses of a property. It also protects residential properties from commercial development.

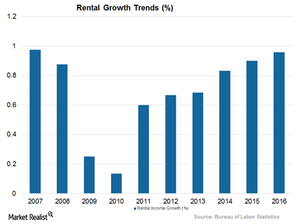

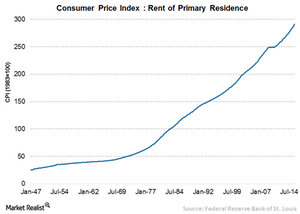

Why Rent Is Going through the Roof

As more and more people seek apartments, rent has also been rising rapidly. In fact, rent has been rising faster than the overall cost of living in the US.

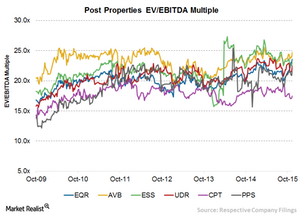

What Post Properties’ Higher-than-Average EV-to-EBITDA Multiple Means

Post Properties’ EV-to-EBITDA ratio is in line with its historical valuation, ranging between 12.2x–25.5x, with a current EV-to-EBITDA ratio of ~21.7x.

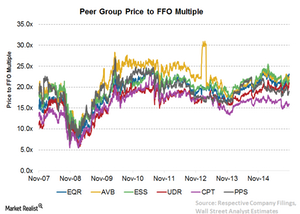

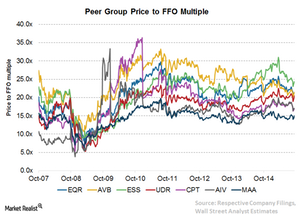

Assessing Post Properties’ Average Price-to-FFO Multiple

Post Properties’ TTM price-to-FFO multiple is in line with its historical valuation at around 18.9x.

A Must-Read Company Overview of Post Properties

Headquartered in Atlanta, Georgia, Post Properties is structured as an REIT and completed its initial public offering in 1993.

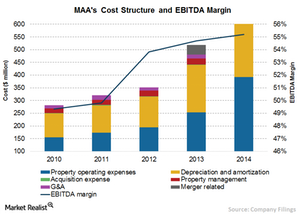

MAA’s EBITDA Margin: Lower than Industry Average

MAA’s EBITDA margin is lower than the industry average of 57.7%, as well as the margins reported by some of the company’s peers.

Camden Property Trust: Its History and Its Business

Camden Property Trust (CPT) is the fifth largest apartment REIT in the United States. At the end of fiscal 2014, it had 181 multifamily properties comprised of 63,163 apartment homes.

Why Essex Property Trust Trades at a High Price-to-FFO Multiple

A close look at Essex Property Trust’s trailing-12-month price-to-FFO multiple shows that it’s in line with its historical valuation.

Analyzing Equity Residential’s Higher Price-to-FFO Multiple

The most common way to calculate the relative value of a REIT like Equity Residential (EQR) is the price-to-FFO (funds from operations) multiple.

What Are the Major Brands of AvalonBay Communities?

AvalonBay Communities’ brands focus on consumer preference as well as location and price. They help differentiate its apartments from the competition.

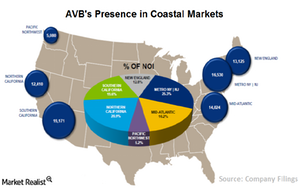

An Overview of AvalonBay Communities’ Geographic Coverage

The distribution of properties in attractive US coastal markets reflects AvalonBay Communities’ geographic diversification strategy.

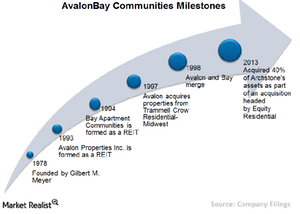

Investing in AvalonBay Communities: A Must-Know Company Overview

AvalonBay Communities is a REIT focused on developing, redeveloping, acquiring, and managing high-quality apartment communities in high barrier-to-entry US markets.

Investing in Equity Residential: A Company Overview

Equity Residential was formed as a REIT. It became a publicly traded company in 1993. It’s part of the S&P 500 Index. It employs about 3,500 people.