Apollo Investment Corporation

Latest Apollo Investment Corporation News and Updates

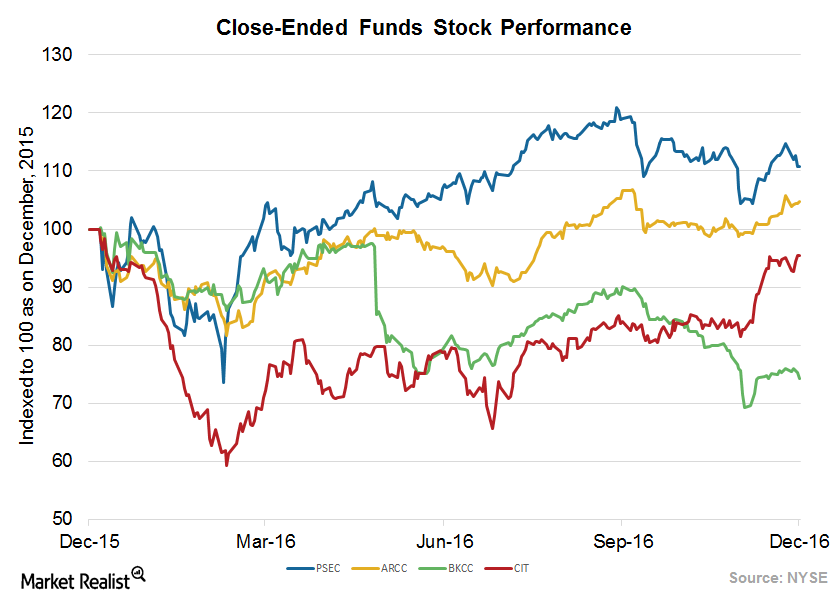

Why Closed-End Funds Are Not That Enthusiastic about Rate Changes

Prospect Capital (PSEC) is strengthening its capital position in order to take advantage of mispricing during volatile times.

Prospect’s Valuation Discount Consistent on Lower Originations

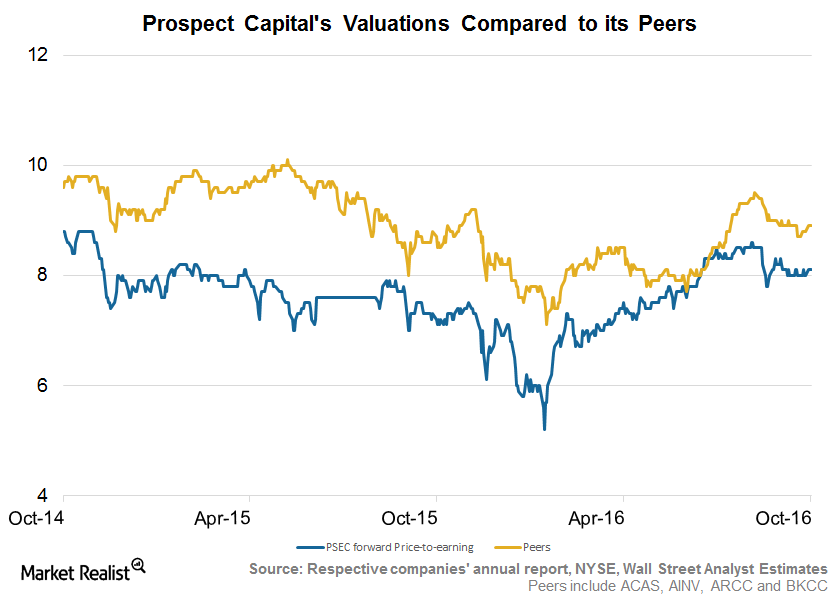

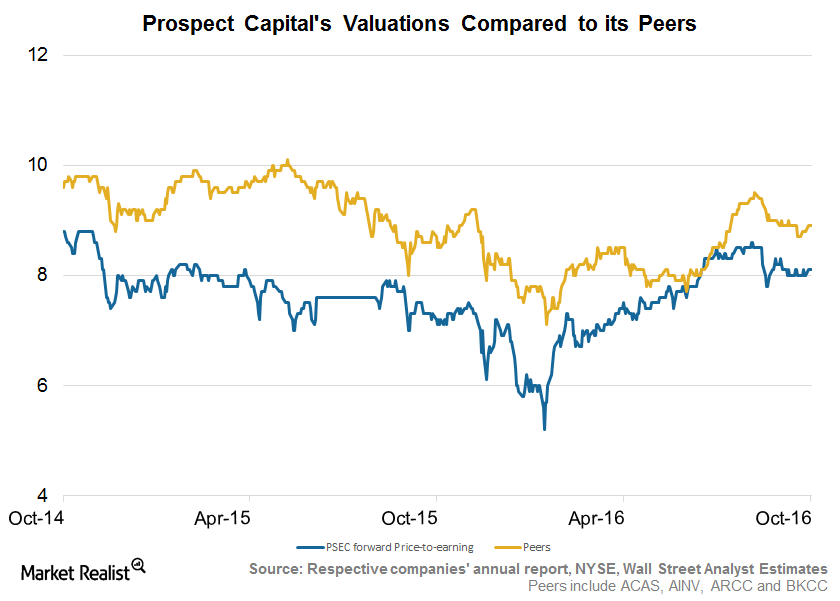

Prospect Capital’s (PSEC) stock has fallen ~3% in the past quarter, and it has risen ~11% in the past year. The company is currently trading 7% lower than its 52-week high.

Prospect Capital’s Valuations: Fair amid Originations, Leverage

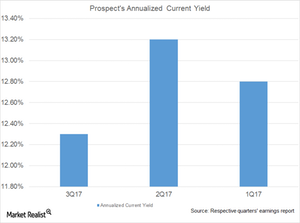

Prospect Capital (PSEC) stock rose 3.0% over the past three months and 20.0% over the past year. The company is currently trading 5.0% below its 52-week high.

Prospect Valuations Fair amid Rising Originations, Strong Yields

Prospect Capital’s (PSEC) stock fell ~7% in fiscal 1Q17 (September quarter) but has risen ~6% in the past 12 months.

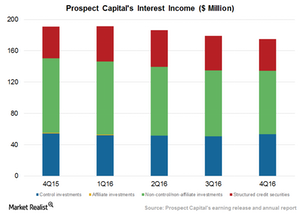

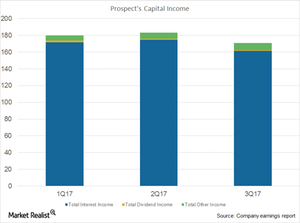

Why Prospect’s Investment Income Fell

In fiscal 2Q18, Prospect Capital’s (PSEC) total investment income was $162.4 million compared to $183.4 million a year earlier.

Prospect Capital’s Valuation: Fair or Discounted in Long Term?

Prospect Capital (PSEC) stock has fallen 14.5% over the past six months and 16.9% over the past year.

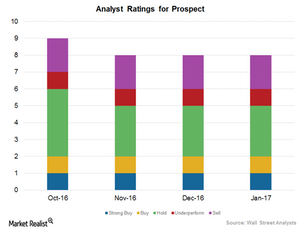

Prospect Capital’s Ratings: What Wall Street Analysts Have to Say

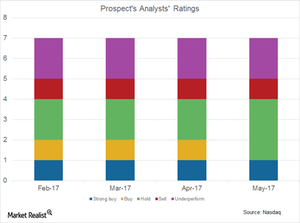

Although Prospect Capital (PSEC) has been delivering decent returns to investors, there has not been much change in the analysts’ ratings.

Prospect Capital’s Increasing Valuations in 2017

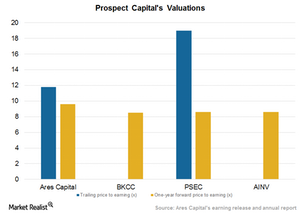

Analysts have given PSEC a one-year price target of $8.50 from the current price level, reflecting 0.7% growth.

Prospect Capital’s Total Investments Increase in 2017

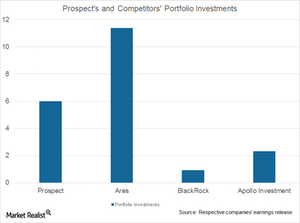

In fiscal 3Q17, Prospect Capital’s total value of investments stood at $6.0 billion in 125 companies, compared to $5.9 billion in fiscal 2Q17 in 123 companies.

Prospect Capital Prioritizes Secured Lending

About 70% of Prospect Capital’s portfolio is composed of first and second lien secured loans

Prospect Capital Adopts a Conservative Approach in Fiscal 3Q17

Prospect Capital’s (PSEC) originations decreased in fiscal 3Q17 to $449.6 million compared to $469.5 million in fiscal 2Q17.

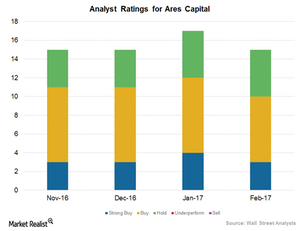

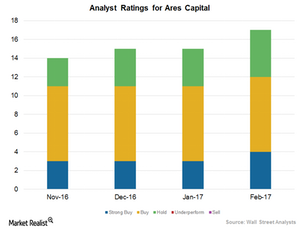

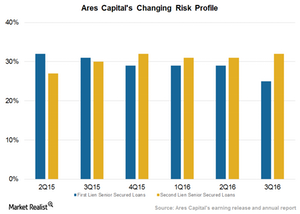

Ares Capital’s Analyst Ratings Suggest Stable Earnings in 2017

In February 2017, 12 of the 17 analysts covering Ares Capital, or ~71%, have rated it as a “buy” or a “strong buy.”

What Analyst Ratings Say about Ares Capital’s Performance

Analysts’ ratings for Ares Capital Ares Capital’s (ARCC) analyst ratings have improved over the past few months due to rising earnings and originations. So far in February 2017, twelve of the 17 analysts covering the company have rated it as a “buy” or a “strong buy.” Five analysts rated it as a “hold.” Since January 2017, Ares […]

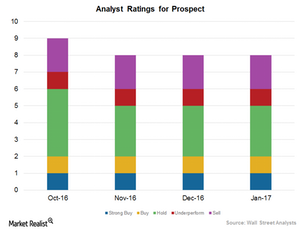

What Analyst Ratings Suggest about Prospect’s Performance

Analysts’ ratings for Prospect Of the eight analysts covering Prospect Capital (PSEC), two rated it a “buy” or “strong buy” in January 2017. Three analysts, or ~37.5%, rated it a “hold.” One analyst rated Prospect an “underperform” and two analysts rated the company a “sell.” Prospect’s mean target price is $8.05 per share, implying a fall of 7.9% […]

With Net Exits and Improved Yields, Prospect’s Valuation Is Fair

Fiscal 2Q17 net exits Prospect Capital (PSEC) stock has risen 16% over the past three months and 16% over the past year. The company is currently trading near its 52-week high. The company saw net exits of $175.5 million in fiscal 2Q17, with higher exits from first-lien holdings. It saw lower leverage mainly due to higher exits, […]

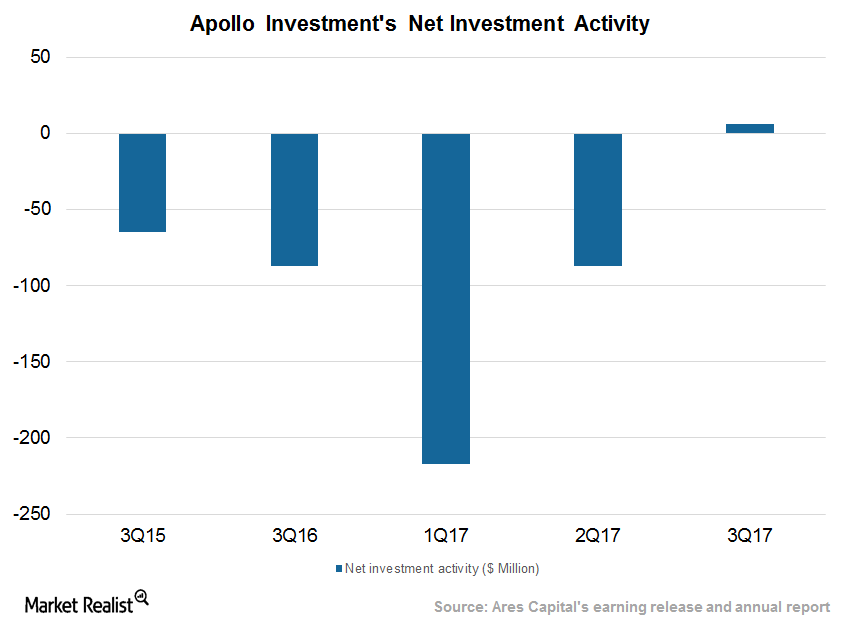

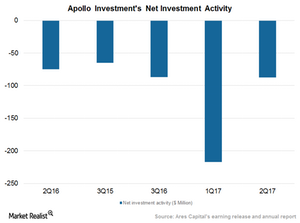

Apollo Investment Sees Net Investments Turn Positive in Fiscal 3Q17

In fiscal 3Q17, Apollo Investments (AINV) sold $17.1 million in investments and repaid $178.2 million.

Apollo Investment Valuations Fair amid Marginal Improvements

In fiscal 3Q17, Apollo Investment (AINV) repurchased 2.3 million shares at a weighted average price per share of $5.90 for a total cost of $13.6 million.

How Analysts View Apollo Investment in 2017

Four of the 15 analysts covering Apollo Investment (AINV) rated it a “buy” or “strong buy” in January 2017.

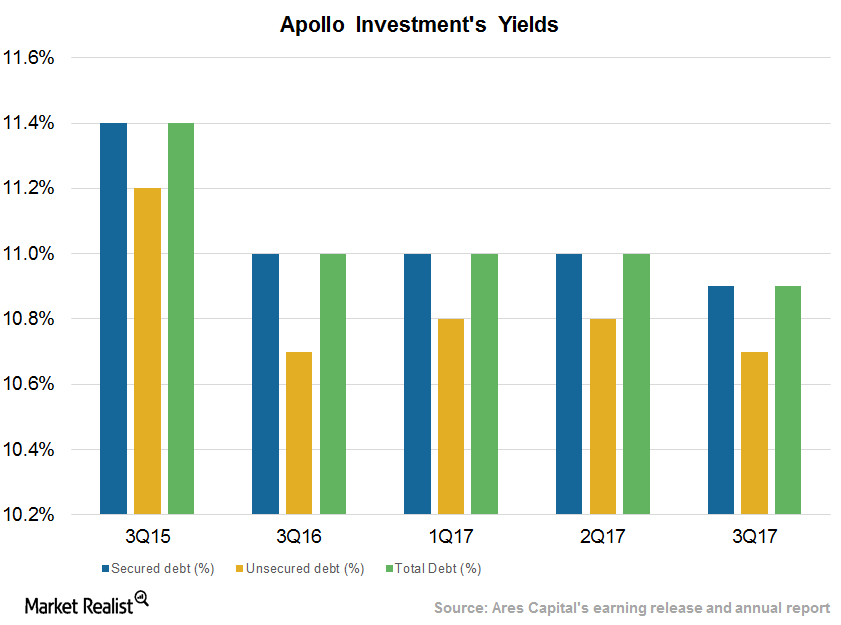

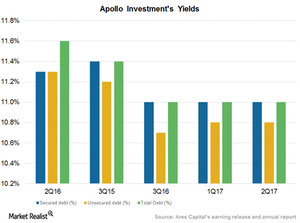

Apollo Investment’s Yields Stabilize on First and Second Liens

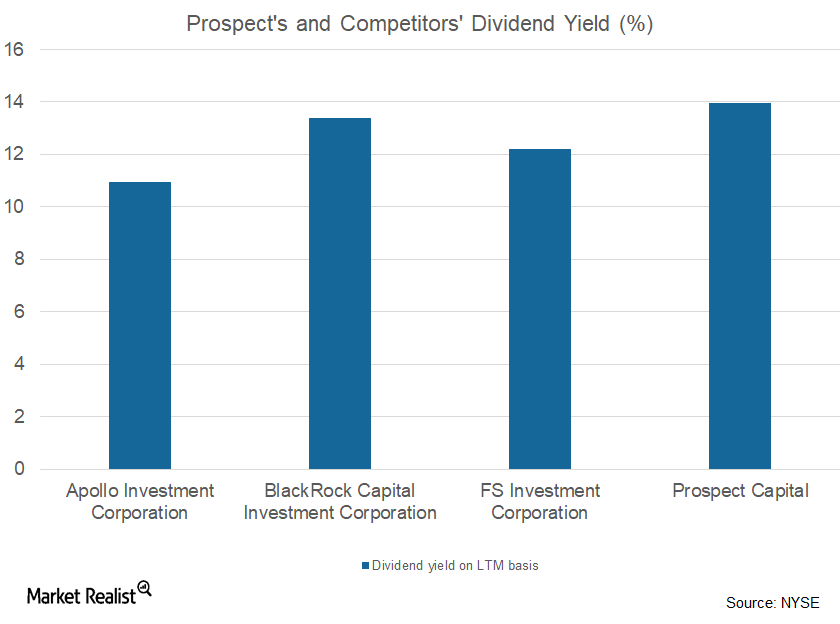

Apollo Investment’s (AINV) yields have declined and stabilized at ~10.9%, on par with average returns garnered by other closed-end funds.

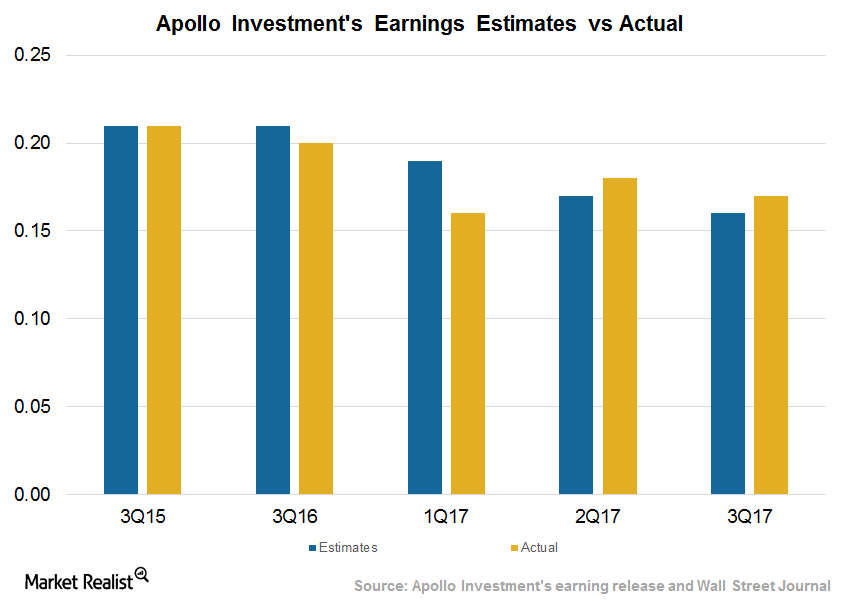

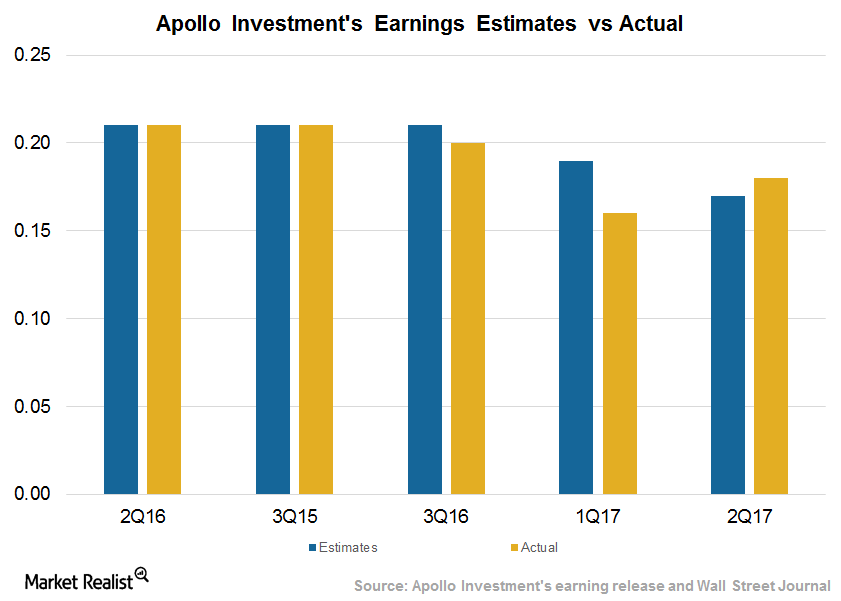

Apollo Investment Earnings Show Signs of Stabilization in Fiscal 4Q17

On February 6, 2017, Apollo Investment (AINV) posted earnings per share of $0.17 in fiscal 3Q17, beating analyst estimates of $0.16.

Prospect Capital’s Performance to Rise Marginally in 2017

In this series, we’ll look at Prospect Capital’s expected performance, deployments, portfolio strategy, yields, balance sheet strength, dividends, and valuations.

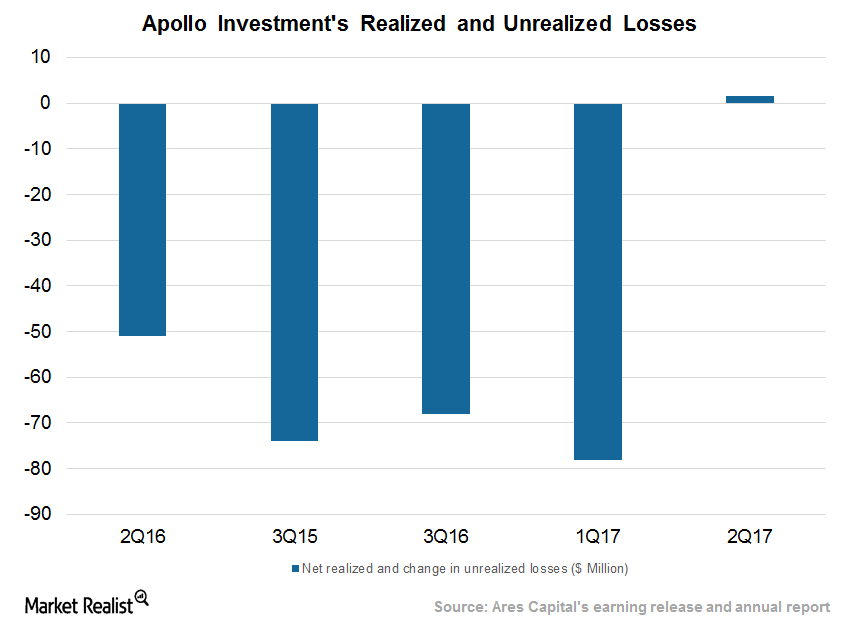

Apollo Investments Sees Gains and Reversal on Portfolio

Apollo Investment’s (AINV) realized and unrealized gains stood at $1.6 million in fiscal 2Q17 compared to realized losses of $42.6 million in fiscal 1Q16.

Apollo Investment’s Yields Stabilize, Reduced Exposure in Energy

At the end of fiscal 2Q17, Apollo Investment’s (AINV) oil and gas investments represented 9.7% of its total portfolio, or $246 million.

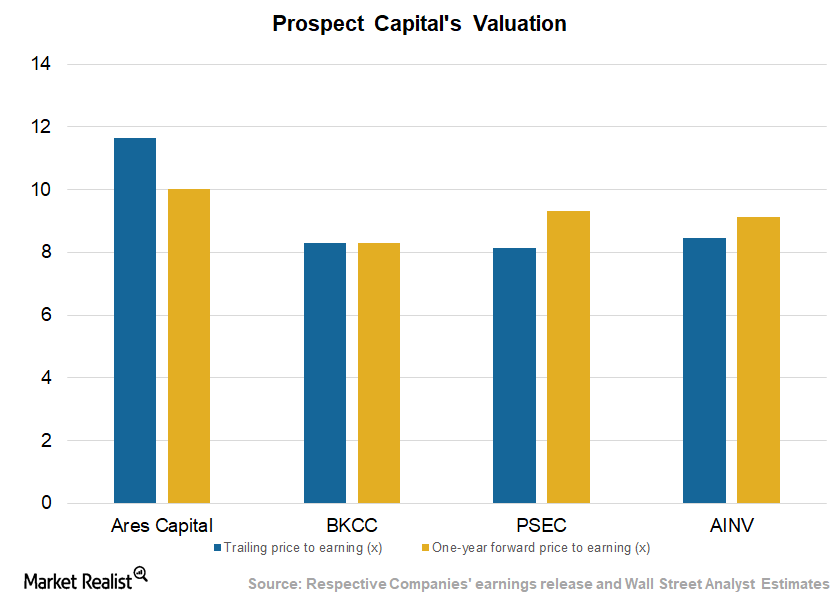

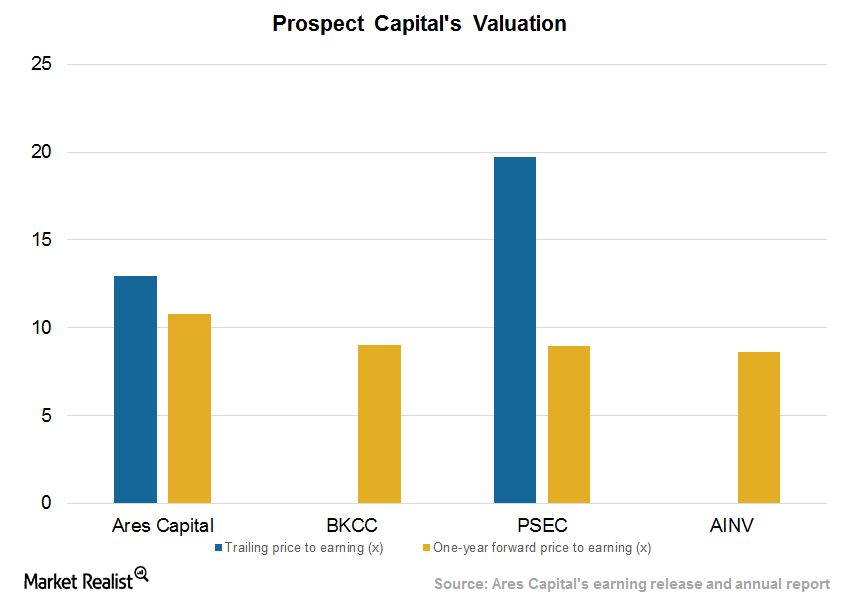

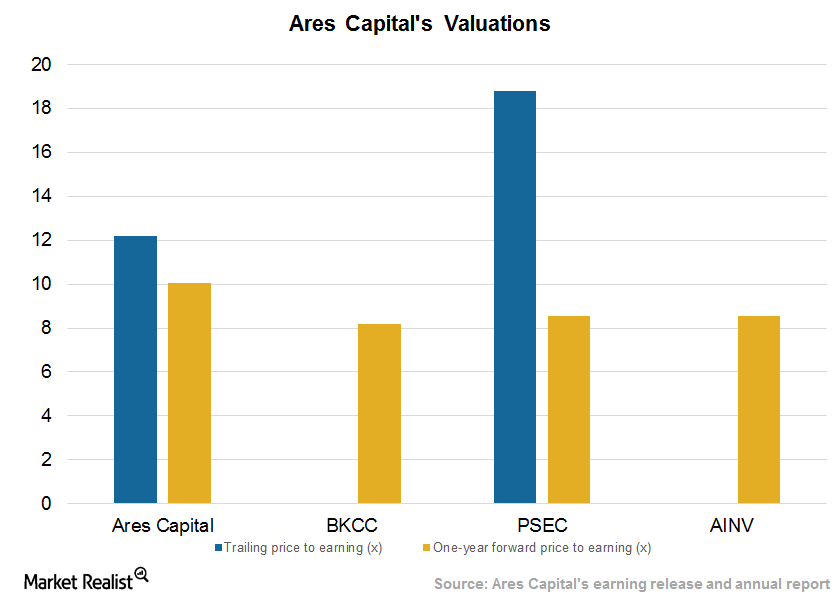

AINV’s Valuation Fair, Stock Can Rise on Earnings Surprise

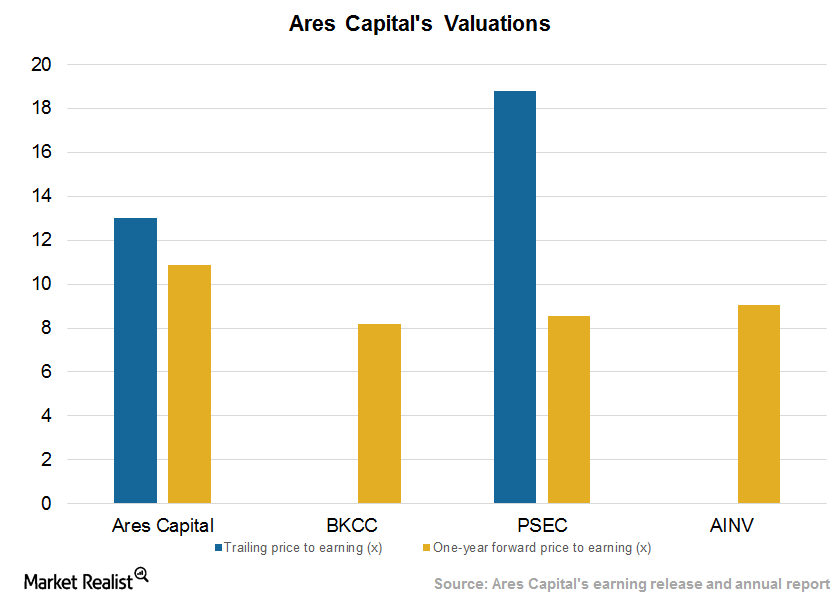

Currently, Apollo Investment (AINV) is trading at 8.5x on a one-year forward earnings basis. Its peers are trading at 8.8x.

Apollo Investment’s Net Exits Trend Expected to Reverse in 2017

Apollo Investment’s (AINV) total portfolio stood at ~$2.6 billion in fiscal 2Q17 compared to ~$3.2 billion in fiscal 2Q16.

Apollo Investment Improved Bottom Line on Select Investments

Apollo Investment (AINV) posted earnings per share of $0.18 in fiscal 2Q17, compared to analyst estimates of $0.17. In this series, we’ll study AINV’s performance, yields, capital deployment, portfolio, dividends, and valuations.

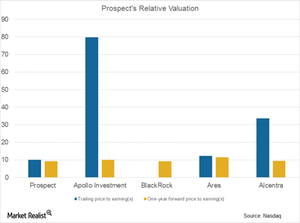

Apollo, BlackRock Target Less Risk, Unlike Ares, Prospect

Over the past few years, closed-end funds (PSP) have deployed funds in middle market companies with better credit ratings.

Closed-End Funds Are Affected by Originations, Rates

Closed-end managers deploy money in middle market companies engaged in businesses across sectors by raising capital through share issuances.

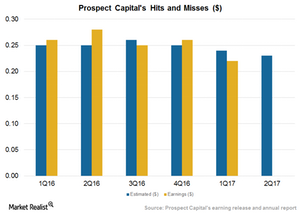

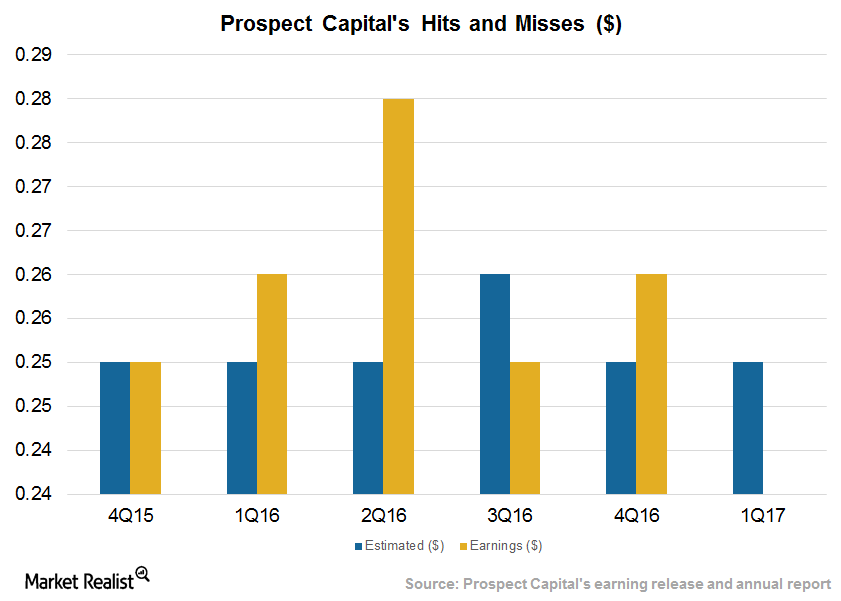

What to Expect of Prospect Capital’s Earnings in Fiscal 1Q17

Prospect Capital (PSEC) is expected to post earnings per share (or EPS) of $0.24 in fiscal 1Q17, a fall of $0.01 compared to estimates.