Best Companies to Invest in Amid a Slowing Economy in 2022

U.S. GDP contracted in the first half of 2022. What are the best companies to invest in 2022 amid a slowing economy? Here's what investors need to know.

Aug. 1 2022, Published 8:42 a.m. ET

The U.S. GDP contracted at an annualized pace of 0.9 percent in the second quarter after falling by 1.6 percent in the previous quarter. Whether we want to call it a recession or not might differ based on how we define one but the U.S. economy is undeniably slowing down. What are the best companies to invest in amid a slowing economy?

After its July meeting, the Fed admitted that the U.S. economy is slowing down. It also pointed to the weakness in the housing market. But then, the Fed didn't exactly break the slowdown news and only reaffirmed what the markets have been fearing.

The Fed expects growth rates to fall more.

The Fed has said multiple times that it doesn't want to enforce a recession in the U.S. even though its rate hikes might lead to one. In the July press release, the Fed said that it's committed to bringing down inflation towards the targeted 2 percent. However, it warned, “This process is likely to involve a period of below trend economic growth and some softening in labor market conditions, but such outcomes are likely necessary to restore price stability.”

Several economic sectors are feeling the pain.

Several economic sectors are feeling the pain including housing and mortgage, consumer discretionary, business investment, and digital ad spending. The headline employment numbers are still impressive but trouble seems to be brewing. Many companies admitted during the recent earnings call that they're looking to cut back on hiring in the coming months.

These are the best companies to invest for the long term.

More often than not, market crashes are an opportunity to buy quality stocks, at least for long-term investors. Incidentally, even Warren Buffett invested billions buying stocks in the first quarter of 2022 after almost two years of subdued buying activity. Here are the three best companies to invest in right now:

- Nvidia (NYSE: NVDA)

- Amazon (NYSE: AMZN)

- Ford (NYSE: F)

Nvidia is among the best long-term stocks to buy in 2022.

Chip stocks have crashed amid the expected fall in PC and smartphone sales in 2022. Companies like Micron and Intel also provided a dismal business outlook, which added to the gloom. NVDA has been among the worst performing chipmakers in 2022 and along with the fall in chip stocks, it bore the brunt of investors’ apathy toward growth names.

However, Nvidia isn't merely a chipmaker but an innovation leader. The company is a play on multiple long-term investment themes like electric cars and blockchain. Its valuations look reasonable after the crash. It wouldn't be pretentious to say that Nvidia is among the companies that have the potential to become the next Apple stock.

Amazon is a secular growth story.

Amazon is a secular growth story. From e-commerce, cloud, digital advertising, and streaming, it's present in multiple high-growth industries. The company’s growth rates have tapered down and the revenue growth in the second quarter of 2022 fell to the lowest level since the dot com bust days.

However, as the high base effect withers away, its numbers will start to look much better in the back half of the year. Amazon is also working to address overcapacity and overstaffing issues by cutting down on new investments and lowering its headcount.

These measures will pay off in the medium term. From a valuation perspective, Amazon looks like a good buy. Redburn analyst Alex Haissl believes that the company’s cloud operations alone could be worth $3 trillion, which is over three times the current market cap.

After Amazon’s second quarter 2022 earnings release, several analysts raised their target prices and Barclays termed it the best stock to buy in its universe of large-cap stocks. Amazon is growing both organically and inorganically. After completing the MGM Holdings deal, which will enhance its streaming offering, it announced the acquisition of One Medical, which would help increase its target market.

Overall, Amazon appears to be one of the best companies to invest in both in the long term as well as the short term.

Ford could give pure-play EV companies a tough fight.

Ford is another good company to invest in right now. While the company is still in the early days of its EV (electric vehicle) pivot, the journey has been inspiring and its new models are getting a good response. It's also scaling up production and said that its July EV production is expected to hit 14,000 vehicles.

By the end of 2023, Ford expects to have an annual run rate capacity of 600,000 EVs, which is expected to rise to 2 million by 2026. In 2023, Ford will start releasing the separate results of its electric car business, which was rechristened Ford Model e. This would help in increasing transparency and provide insights into the profitability of Ford’s electric cars.

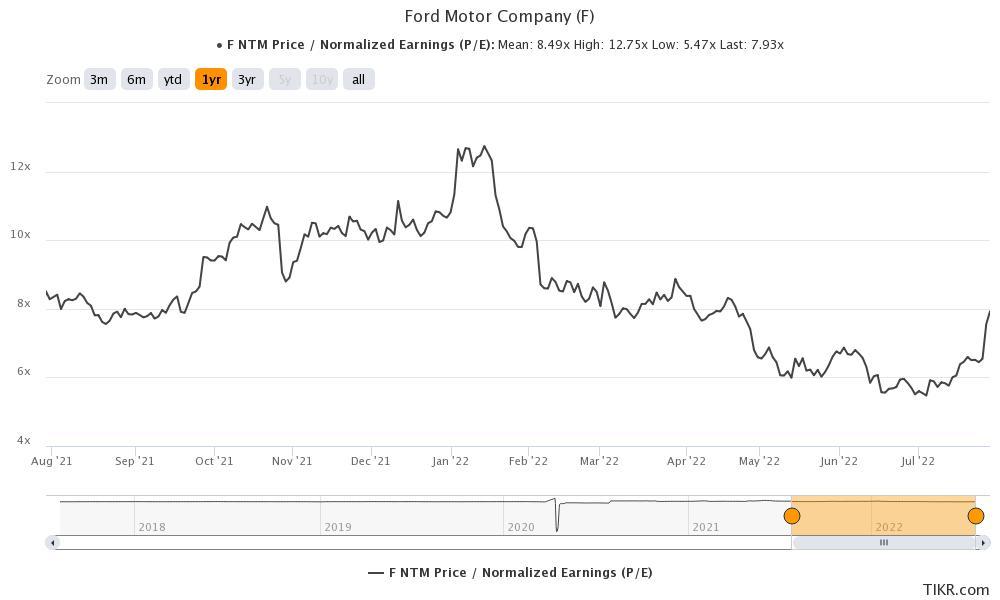

Barring Tesla, all other pure-play EV companies are currently posting losses. Ford is a good stock to buy for dividend investors also as its recent dividend hike lifted the yield to above 4 percent. With an NTM PE multiple of just under 8x, Ford looks too tempting to ignore at these prices.