Great Stocks to Buy Now as Market Recover From Lows

U.S. stocks have whipsawed in 2022. What are some of the great stocks for investors to buy now before markets recover fully from the lows?

July 22 2022, Published 9:36 a.m. ET

U.S. stock markets have whipsawed in 2022 and entered a bear market in June. However, stocks have since recovered. The crash has opened up opportunities in some of the fundamentally strong stocks. What are some of the great stocks to buy now before markets recover fully from the lows?

Analysts have a mixed opinion about U.S. stocks in 2022. While Morgan Stanley and Bank of America expect the S&P 500 to fall from these levels, JPMorgan sees the index surging to a record high before the year-end. Most brokerages have been lowering their 2022 predictions for the S&P 500 amid surging inflation and the Federal Reserve’s rate hike. The Fed is meeting on July 26–27 and economists expect a rate hike between 75 basis points and 100 basis points.

U.S. stocks have recovered from their lows.

U.S. stocks have recovered from their lows and the S&P 500 is now trading near 4,000. The index has crossed above its 50-day SMA (simple moving average) for the first time since April but remains below the 200-day SMA. Nonetheless, the S&P 500 rising above the 50-day SMA is a bullish technical indicator. There was a death cross formation in the index in March 2022, which is a bearish indicator.

This week looks crucial for U.S. stocks as we have the Fed’s July meeting as well as earnings releases from several leading tech companies, which would set the direction for stocks for the coming weeks.

Speculative growth stocks might continue to remain under pressure.

Amid the market sell-off, some of the speculative growth stocks, especially those that went public over the last two years, have crashed. While some may appear tempting after having lost over 80 percent from their peaks, market sentiments toward the loss-making 2025 kind of stories have changed for good.

However, as is the case with every market crash, even some of the fundamentally strong stocks have also plunged amid the wider market sell-off. No wonder, Warren Buffett, who was sitting on the sidelines for the last many quarters, has invested billions of dollars towards buying stocks in 2022.

These are three great stocks investors can consider in 2022.

The following are three great stocks that you can buy in 2022 and bet on an eventual recovery in U.S. markets.

- Alphabet (NYSE: GOOG)

- Berkshire Hathaway (NYSE: BRK.B)

- Alibaba (NYSE: BABA)

Alphabet looks like the best FAANG stock to buy.

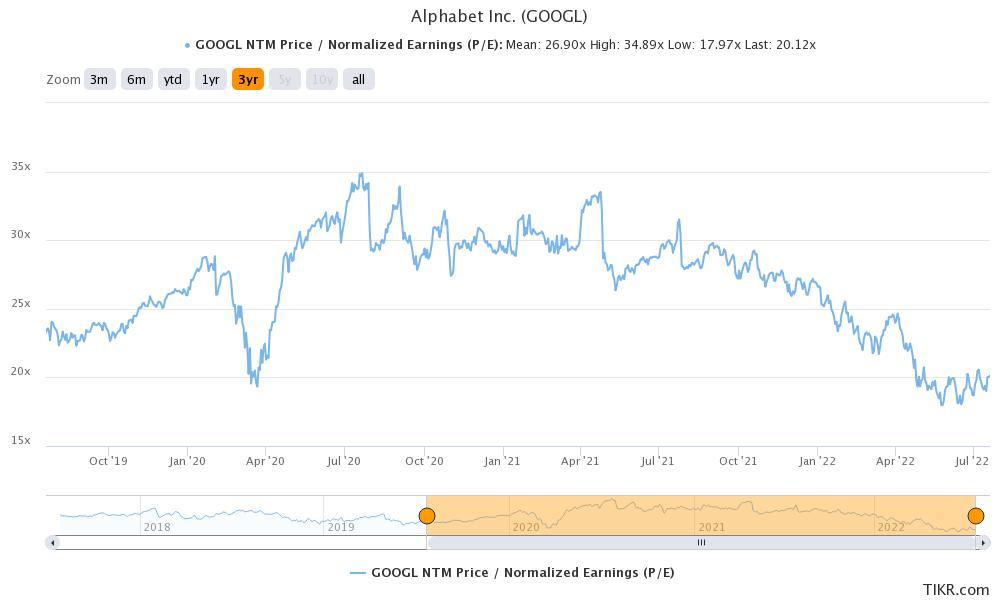

Alphabet has completed its 20-for-1 stock split. The company has been impacted by the current slowdown and has put a hiring freeze in place. However, with an NTM (next-12 month) PE multiple of 20x, the Google-parent looks too cheap to ignore. The stock’s valuation multiples are similar to the March 2020 lows when U.S. stocks crashed amid the COVID-19 pandemic. While the FAANG universe has also looked vulnerable in 2022, GOOG is one great stock to consider after the crash.

Berkshire Hathaway looks like a great stock after the crash.

While the broader markets crashed, Berkshire Hathaway hit a record high in 2022. It has since come off the highs and is in the red for the year. But, the Buffett-led company is outperforming the S&P 500.

Berkshire is a great buy for the long term and the recent correction looks like a good opportunity to buy the stock. The company is a complex conglomerate and is present in several businesses, which makes it a proxy for the U.S. economy. While it could have periods of short-term underperformance, over the long term, BRK.B stock should beat the S&P 500, even if not the way it used to do in the last century.

Alibaba is a play on the Chinese economy.

Alibaba was at the forefront amid China’s tech crackdown. Now, the country looks done with the crackdown amid a slowing economy. Alibaba, along with other U.S-listed Chinese stocks, rebounded after China signaled an end to the crackdown and also vowed to support the foreign listing of Chinese companies.

There are several headwinds for BABA, including the feared delisting in the U.S. A slowing Chinese economy is also hurting the company's top-line growth. However, there are three reasons why it looks like a great stock to buy. First, the worst of the crackdown in China seems to be over and BABA might have bought peace with Chinese authorities after the record $2.8 billion fine.

Second, Alibaba’s valuations look reasonable and the cloud operations are expected to drive the next round of growth for the company. Finally, China might approve Ant Financial's IPO, which would help Alibaba monetize its stake. The IPO was stalled in 2020 after Jack Ma made critical comments about Chinese regulators. Bernstein has also upgraded BABA stock. Bernstein analyst Robin Zhu sees an eventual Ant Financial IPO supporting Alibaba’s valuation.