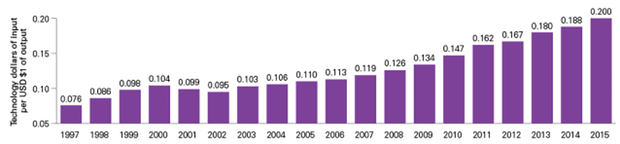

Data Is the New Crude, and Paradata Is Refining It

Everyone’s heard that data is the new oil. But Paradata shows that data is like crude oil—if you don’t refine it into something you can use, it’s useless.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.