Data Is the New Crude, and Paradata Is Refining It

Everyone’s heard that data is the new oil. But Paradata shows that data is like crude oil—if you don’t refine it into something you can use, it’s useless.

May 3 2021, Updated 11:22 a.m. ET

Everyone’s heard that data is the new oil, but that’s only part of the truth. Paradata understands that data is like crude oil—if you don’t refine it into something you can actually use, then it’s useless.

While companies and investors alike have access to a new generation of data architecture tools, the quality of their data can be shockingly poor. Beyond the need to visualize and present data effectively, how can you trust that the data you have is reliable? And how can you know what data is out there? Paradata breaks down a huge range of data so that you can leverage each component to make better decisions.

The company recognizes that business decisions should not only be data-driven, but that that data should be high-quality and available at the point of making a business decision. In today’s supply-chain–driven business, understanding key suppliers and their associated risks is essential—and it’s time to start treating data the same way. Instead of taking data points at face value, without assessing subjective biases and risks, Paradata provides a component-level view and a new level of transparency. Using machine learning, Paradata analyzes, classifies, and evaluates data so that you can work with clear, actionable insights. Let’s take a closer look at why that approach is so important in today’s market, where data is the new oil.

Paradata responds to the need for better-quality data

We live in the most transparent generation—but we have the least visibility into that transparency. Lack of access to publicly available information is the challenge of our time. Moreover, the data that companies and investors rely on is often stale, incomplete, and unverifiable.

Businesses’ increasing need for data had led to a new generation of data architecture. That new data architecture identifies a business’s needs, collects relevant and accurate data, and makes it accessible to the right people in the right context. The result is that companies that leverage data architecture can cut costs, lower their risks, and—above all—increase compliance. At the same time, increasing digitization is driving big data and the business analytics industry. Data’s dynamic nature means enterprises are adapting their data architecture to the changing business environment.

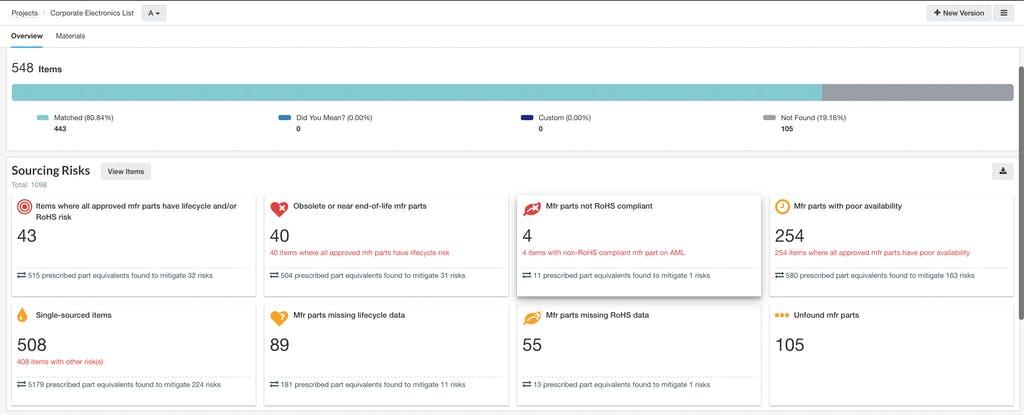

Paradata in action.

The big data and business analytics boom

IDC forecasts that global revenue from big data and business analytics solutions will reach $189.1 billion in 2019. Of that total, $77.5 billion should come from IT services and $20.7 billion from business services. IDC expects revenue from big data and business analytics solutions to grow at a compound annual rate of 13.2%, reaching $274.3 billion between 2018 and 2022. The banking, discrete manufacturing, and professional services industries make the most use of these tools.

The growing demand for data and analytics has drawn some of the world’s top guns in tech into the space. The big tech companies making increasing investments include Amazon (AMZN), IBM (IBM), Oracle (ORCL), Microsoft (MSFT), SAS, and Google (GOOG). Most cloud companies have their own data warehouse services, the leaders being Amazon’s Redshift, Google’s BigQuery, and the late-stage unicorn Snowflake Computing, being the reference standard. Oracle (ORCL), IBM, and SAP also have competing solutions.

Several companies also specialize in big data software for specific functions—like Salesforce (CRM) for CRM (customer relationship management) and SAP for ERP (enterprise resource planning).

Salesforce is the world’s largest CRM platform, with a 19. 5% market share in 2018. Its revenue rose 26% year-over-year last year. Worldwide CRM software provider revenue rose just 15.6%, according to Gartner. SAP is the world’s largest ERP software provider. Its revenue rose 10.6% year-over-year last year while worldwide ERP revenue rose 10%, also according to Gartner.

With the mentality that data is the new oil, investors have realized the growth potential of big data and business analytics, and they’re increasing their exposure to this market. This shift reflects in Salesforce and SAP’s higher market caps, which have risen 54% and 20% since 2018.

The data-driven technology sector

In a dynamic industry like technology, investors understand the importance of high-quality data that offers actionable insights. Semiconductor companies use internal data like sales, capacity, expenses, and profits as well as market intelligence like forecasts from third-party sources, customers, and suppliers. They also leverage macro data like tariffs, corporate taxes, and trade policies alongside competitive intelligence like competitors’ market share, new product specifications, launches, prices, and go-to-market strategies. Market participants analyze these data points to prepare production plans, capital spending, product roadmaps, product launches, inventory management, and many more considerations.

Consider the data-driven semiconductor sector as an example. Semiconductor companies like Intel (INTC), Micron (MU), and Texas Instruments (TXN) manufacture chips according to demand. Given the industry’s dynamic nature, they face the risk of inventories becoming obsolete. To hedge this risk, they look at several data points. These components include their past sales, end-consumer demand, new product launches from original equipment manufacturers or OEMs, channel inventory, their own inventory, and market prices. From these data points, semiconductor companies decide what and how much to both produce and store as inventory.

Beyond the companies themselves, investors in the space also make use of several data points. Market demand, market share, earnings, revenue, cash flows, exposure to different markets, geographies, and customers are key data points to consider. Investors compare these metrics with peer companies to understand a company’s earnings potential, and Paradata is making these components more accessible and more actionable.

If data is the new oil, then investors need to leverage it

Companies use real-time data to make strategic decisions that maximize returns and minimize costs. Meanwhile, investors across industries leverage data to buy and sell stocks at the right time to maximize returns. Publicly available data points include earnings and press releases, third-party industry estimates, stock prices, fundamental valuations, and macroeconomic policies.

The US-China tariff war and Huawei ban also highlight the need for Paradata’s clear, reliable data. When the US announced its Huawei ban on May 15, Goldman Sachs downgraded the stocks with the greatest exposure to China. The majority of these stocks were semiconductor companies, and many investors cashed out profits a trade war uncertainties blurred chip companies’ outlook.

To restore confidence, Fed Chair Jerome Powell hinted on June 4 that the Fed could ease its monetary policy to protect the economy from trade tensions with China and Mexico. Well-informed investors purchased the stocks that were the most affected by the trade war and had high trading volumes, volatility, and valuation. Why? Because data shows that these stocks move significantly on this kind of news. AMD, NVIDIA, and Apple (AAPL) stocks rose 7.2%, 6.9%, and 3.65% on the Fed’s announcement. And since then, these stocks have seen upward momentum. Of course, several company-specific factors drove these stocks as well. All three companies have strong fundamentals and growth opportunities beyond the ongoing trade tensions.

Autonomous vehicles could revolutionize the supply chain

Over the last few years, many large companies and new tech start-ups have increased their efforts to build autonomous vehicles. These self-driving vehicles are expected to bring big changes to the way businesses transport goods and to their overall supply chain logistics. Self-driving vehicles are likely to significantly reduce the need for human resources involved in supply chain logistics as well as the chance of human errors. Building these vehicles is a challenging supply chain effort in itself since it requires bringing a very complex set of components together. This “data center on wheels” requires an unprecedented degree of automation in choosing the supply chain components required to build these complex “products.” Making their supply chain process more reliable and predictable is critical.

In November 2017, Tesla (TSLA) unveiled its semi truck. Tesla claims the truck has enhanced Autopilot capabilities, which could revolutionize the supply chain process for businesses. Soon after the truck’s launch, many large companies—including JB Hunt Transport Services (JBHT), Sysco (SYY), Walmart (WMT), DHL, and PepsiCo (PEP)—pre-ordered Tesla’s semi truck. PepsiCo pre-ordered 100 units while Walmart initially ordered 15 and then increased its order by 30 units in September 2018. These orders reflect companies’ data-driven approach and increasing interest in trying new technologies to improve supply chains and save costs.

Paradata’s supply chain solutions

Paradata is also playing its part in the supply chain. Similar to how Google organizes web pages based on its PageRank algorithm, Paradata’s PartRank™ organizes the data components its customers need to buy from their supply chain based on elements like prices, tariffs, security, and compliance.

These are exactly the kinds of data points that companies and effective investors rely on. When the US implemented the Huawei ban, many US chipmakers reviewed the policy and identified products that comply with the ban and are exempt from Chinese tariffs on American goods. The ban didn’t include technology components produced by US companies’ plants outside the United States. Using data, these companies even found a way around the ban by leveraging their global supply chains.

Paradata’s machine learning engine leverages the wealth of data available in today’s market. The company provides “Decision Analytics” that help customers optimize data components based on their design and business needs. And Paradata just released new capabilities around tariffs to help users identify, quantify, and mitigate tariff and COO impacts as well as alternatives.

Moreover, Paradata deploys its solutions through standard APIs as a standalone web platform, and it’s also integrated with SAP Sourcing Simulation & Optimization on the SAP App Center. Product designers, component buyers, compliance managers, and self-directed investors can take advantage of the platform alongside suppliers and manufacturers to make better decisions.