Performance During Periods of Market Stress

Up until recently, the current nine-year bull market had seen historically low levels of volatility. Despite the low volatility environment, a hypothetical allocation to investment-grade bonds illustrates the potential advantages of effective diversification.

Oct. 10 2018, Updated 4:37 p.m. ET

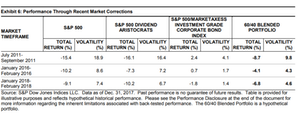

Up until recently, the current nine-year bull market had seen historically low levels of volatility. Despite the low volatility environment, a hypothetical allocation to investment-grade bonds illustrates the potential advantages of effective diversification. These benefits were perhaps most apparent during three specific periods of increased market volatility experienced since the financial crisis of 2009. As shown in Exhibit 6, a hypothetical 60/40 blended portfolio of the S&P 500 Dividend Aristocrats with the S&P 500/MarketAxess Investment Grade Corporate Bond Index resulted in a significant reduction in volatility and 300-700 bps of improvement in drawdown compared to both the S&P 500 as well as the S&P 500 Dividend Aristocrats.

CONCLUSION

Pairing the S&P 500 Dividend Aristocrats with the S&P 500/MarketAxess Investment Grade Corporate Bond Index can provide higher overall yield by adding stable income from high-quality issuers of the S&P 500 while also offering increased relative liquidity compared to the broader investmentgrade corporate market. Additionally, the complementary performance characteristics can provide diversification benefits that may result in lower volatility and potentially higher risk-adjusted returns. The reduced volatility can potentially protect against drawdown risk and lessen the expected frequency of loss.