Fixed-Income Factors in Target Date Strategies

Fixed-income factors are not as widely discussed as equity factors, but they are equally important in designing a target date portfolio in an attempt to improve participant outcomes.

Nov. 30 2017, Updated 4:31 p.m. ET

Fixed-income factors are not as widely discussed as equity factors, but they are equally important in designing a target date portfolio in an attempt to improve participant outcomes. Just as within equities, factors are features of assets that may give better risk/return payoffs over time as they help filter the fundamental macroeconomic forces that drive returns. Within fixed income, these factors can be broadly categorized as being related to interest-rate sensitivity, credit exposure, and inflation sensitivity.

- Interest-rate sensitivity refers to how a security’s price changes when interest rates change. This factor is important to consider for striking a balance between generating income and reducing interest-rate risk.

- Credit exposure from yield-advantaged securities typically generates a positive risk premium over a medium- to longer-term investment horizon, suggesting target-date investments—which are aiming for a long investment horizon—should be biased toward investment-grade, high-yield, and emerging markets debt.

- Inflation sensitivity is important for retirees seeking to maintain their purchasing power when they may not have wage income to compensate for changes in inflation. As a result, target date portfolios will typically increase exposure to this factor over time.

Factor: Interest-rate sensitivity

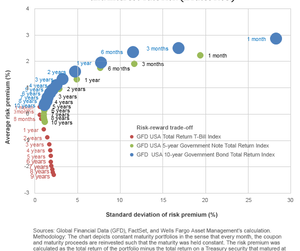

Sometimes it pays to invest in more interest-rate sensitive assets and sometimes it can hurt. A bond with a longer time to maturity generally experiences a greater change in its price than a short-term security does for a given change in interest rates. Reinvestment risk—the variability in returns from reinvesting in a particular strategy due to changes in interest rates—is also a consideration. To illustrate this concept, we compared the expected return (in this case, the average historical returns) with risk (the historical standard deviation of returns) to assess which would provide the greatest expected return for a given level of risk of three portfolios: short term, medium term, and longer term.

Because target date strategies tend to have long investment horizons, they may benefit from holding longer-maturity portfolios than cash and cash alternatives. If interest rates stay flat or eventually rise, however, keeping maturities closer to the intermediate range of the yield curve may be prudent because there is little historical evidence of a benefit to investing in extremely long-term securities relative to intermediate-term securities. Investing in intermediate-term securities, therefore, helps lower the risk of incurring a negative risk premium from reinvestment rate risk that is common with T-bills, but it also attempts to avoid excessive interest-rate risk associated with longer-dated fixed income.