Will US Crude Oil Inventories Push Crude Oil Prices Higher?

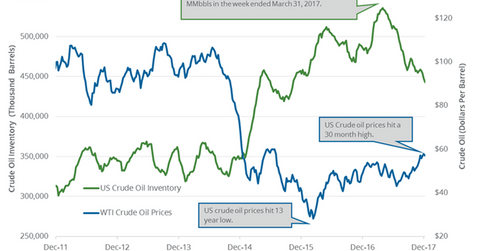

US crude oil inventories fell 17.3% from their peak. So far, they have fallen 8.3% in 2017. Similarly, oil (DWT) (UCO) prices have risen ~9% in 2017.

Dec. 19 2017, Published 9:12 a.m. ET

US crude oil futures

WTI crude oil (UWT) (USO) futures contracts for February delivery rose 0.2% and were trading at $57.3 per barrel at 1:17 AM EST on December 19, 2017. Likewise, March E-Mini S&P 500 (SPY) futures contracts rose 0.04% to 2,695.25 at the same time.

Oil prices were near a three-year high. Higher oil prices benefit energy producers’ (XOP) (IEZ) earnings like Anadarko Petroleum (APC), Newfield Exploration (NFX), and Energen (EGN).

EIA’s crude oil inventories

US crude oil inventories fell 17.3% from their peak. So far, they have fallen 8.3% in 2017. Similarly, oil (DWT) (UCO) prices have risen ~9% in 2017.

The EIA will release the US crude oil inventory report on December 20, 2017. Wall Street analysts estimate that US crude oil inventories would have fallen by 3.15 MMbbls (million barrels) on December 8–15, 2017. Similarly, crude oil inventories at Cushing are expected to fall by 2.2 MMbbls during the same period, according to Bloomberg.

A larger-than-expected fall in US and Cushing crude oil inventories could support oil prices. Higher oil prices benefit funds like the Vanguard Energy ETF (VDE) and the Guggenheim S&P 500 Equal Weight Energy ETF (RYE).

However, traders should be careful. The massive build in gasoline inventories in the last few weeks pressured oil prices. Market surveys expect a build of 2.2 MMbbls on December 8–15, 2017. If the EIA reports a massive build in gasoline inventories, it could pressure oil (DWT) prices.

Next, we’ll discuss OECD’s crude oil inventories.