Energen Corp

Latest Energen Corp News and Updates

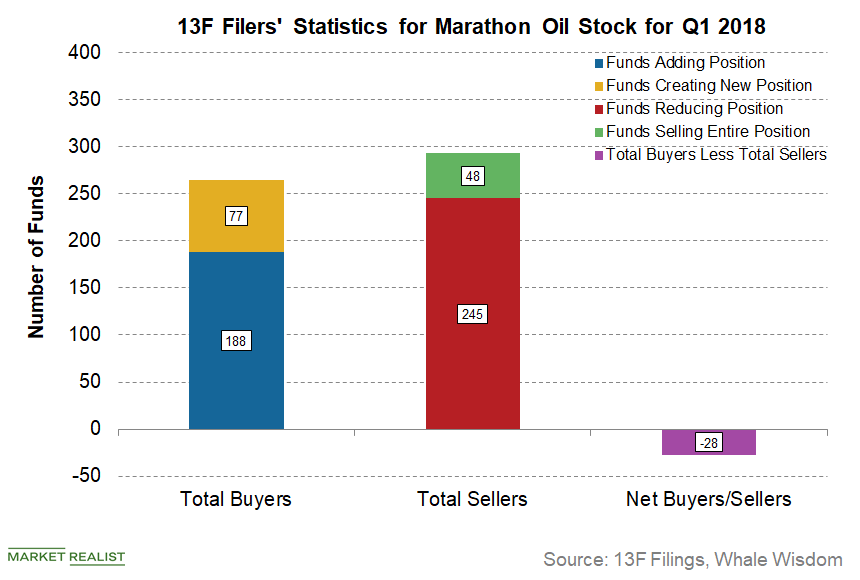

Are Institutional Investors Selling Marathon Oil Stock?

In Q1 2018, 265 funds were “buyers” of Marathon Oil (MRO) stock, either creating new positions or adding to existing positions.

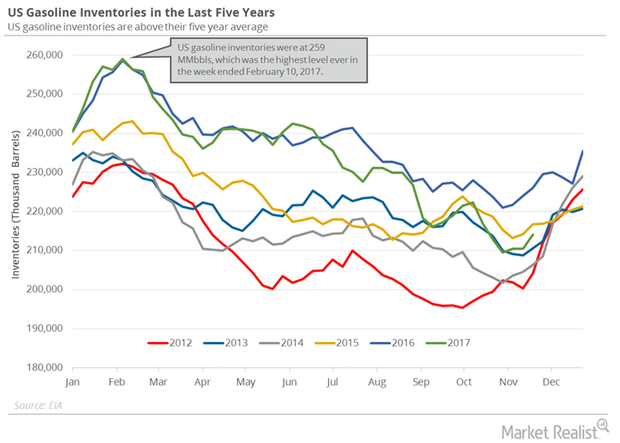

Analyzing US Gasoline Inventories and Demand

The API reported that US gasoline and distillate inventories rose by 9,200,000 barrels and 4,300,000 barrels on November 24–December 1, 2017.

US Gasoline Inventories Weighed on Crude Oil Futures

US gasoline inventories rose by 3,627,000 barrels to 214 MMbbls (million barrels) on November 17–24, 2017, according to the EIA.

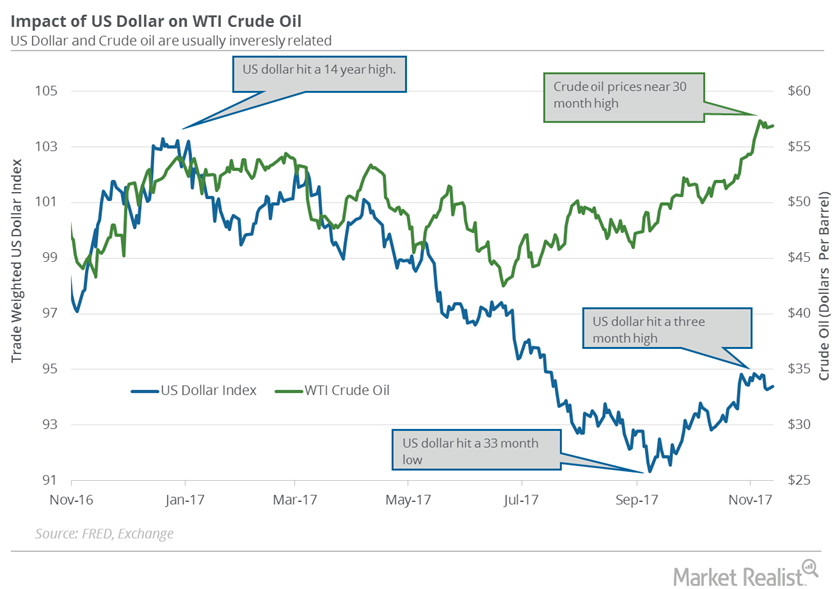

US Dollar Could Pressure Crude Oil Futures This Week

The US Dollar Index rose 0.13% to 94.4 on November 13, 2017. It limited the upside for US crude oil (UWT) (DWT) prices on the same day.

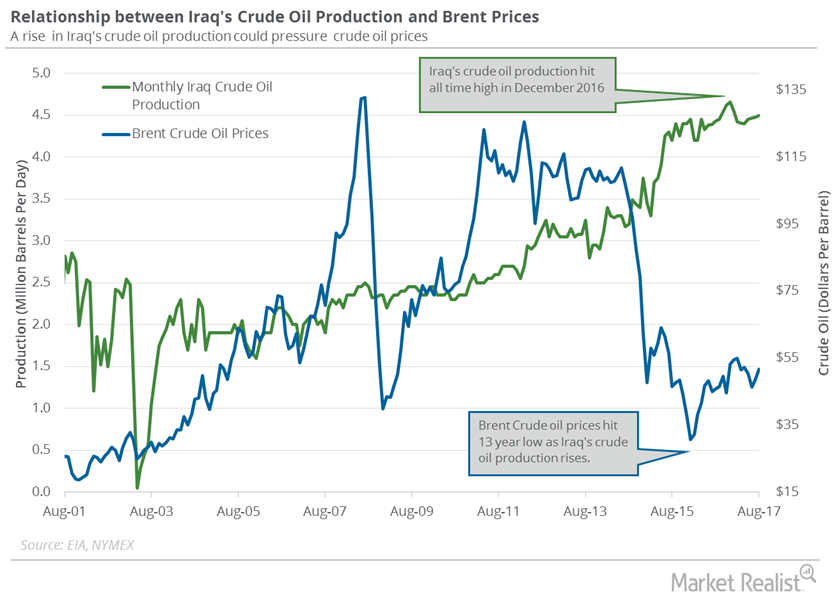

How Iran and Iraq’s Crude Oil Exports Could impact crude Oil Prices

Iraq’s crude oil exports hit 3.98 MMbpd (million barrels per day) in September 2017, according to Bloomberg—its highest level since December 2016.

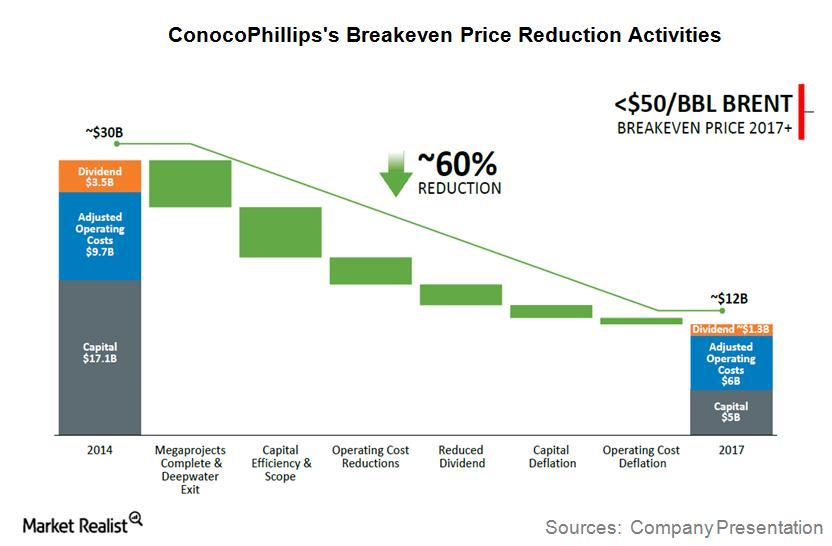

ConocoPhillips’s Steps to Reduce Its Break-Even Price

Since 2014, ConocoPhillips (COP) has been focusing on reducing its break-even price.