US Distillate Inventories Rose for the Sixth Time in 7 Weeks

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks.

Nov. 20 2020, Updated 5:24 p.m. ET

US distillate inventories

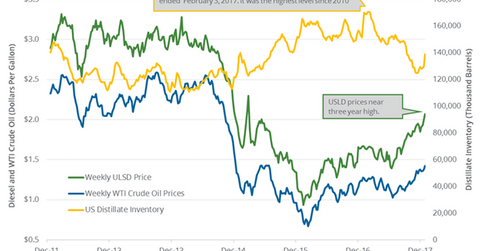

According to the EIA, US distillate inventories rose by 8.8 MMbbls (million barrels) or 6.8% to 138.8 MMbbls on December 22–29, 2017. However, inventories fell by 22.9 MMbbls or 14.2% from a year ago.

Analysts estimated that US distillate inventories could have increased by 0.5 MMbbls on December 22–29, 2017. A massive build in distillate inventories pressured diesel prices on January 4, 2018. US diesel futures fell 0.5% to $2.07 per gallon on the same day. US crude oil (USL) (DWT) and diesel futures diverged on January 4, 2018.

Moves in diesel prices impact US refining companies (CRAK) like Northern Tier Energy (NTI), Holly Frontier (HFC), and PBF Energy (PBF).

Similarly, volatility in oil (USL) prices impacts oil producers (XES) (PXI) like Bonanza Creek Energy (BCEI), Newfield Exploration (NFX), and Goodrich Petroleum (GDP).

US distillate production and demand

US distillate production increased by 116,000 bpd (barrels per day) or 2.1% to 5.6 MMbpd (million barrels per day) on December 22–29, 2017. The production also increased by 263,000 bpd or 5% from the same period in 2016.

US distillate demand fell by 738,000 bpd or 17% to 3.6 MMbpd on December 22–29, 2017. However, demand increased by 796,000 bpd or 29% from the same period in 2016.

Impact

US distillate inventories increased for the sixth time in the last seven weeks. The inventories rose ~11% in the last seven weeks. Any rise in inventories is bearish for diesel and oil (UCO) prices.

US distillate inventories are 1.5% above their five-year average, which is bearish for diesel and oil (USO) prices. If the differences decrease, it’s a bullish sign for diesel and oil prices.

Read Iran, OPEC, Russia, and Crude Oil Inventories Impact Prices and Will US Natural Gas Futures Start 2018 on a Positive Note? for updates on oil and gas.