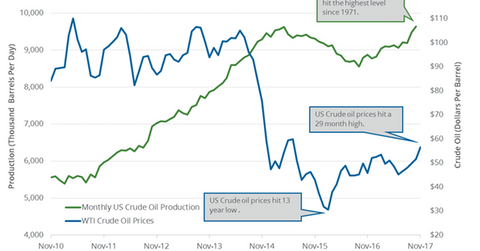

US Crude Oil Output Hit the Highest Level since May 1971

US crude output increased by 167,000 bpd to 9.64 MMbpd in October 2017—compared to the previous month. It was the highest level since May 1971.

Jan. 3 2018, Published 7:56 a.m. ET

Monthly US crude oil output

According to the EIA, the US crude output increased by 167,000 bpd (barrels per day) to 9.64 MMbpd (million barrels per day) in October 2017—compared to the previous month. It was the highest level since May 1971.

The US crude oil output rose 1.8% month-over-month and by 846,000 bpd or 9.6% year-over-year. Any rise in US crude oil production is bearish for oil (BNO) (USL) prices. Moves in oil prices impact funds like the Vanguard Energy ETF (VDE) and the First Trust Energy AlphaDEX Fund (FXN).

Monthly US crude oil production peak and low

Monthly US crude oil production hit a record high of 10.04 MMbpd in November 1970. In contrast, US crude oil production hit 8.5 MMbpd in September 2016—the lowest level in almost four years.

US oil production has risen by 1.08 MMbpd or 12.7% since the lows in September 2016. Higher oil (USO) prices and improving drilling costs supported the increase in US crude oil production.

US crude oil (SCO) prices were at a 30-month high. Higher oil (UWT) prices benefit oil producers (XES) (IEZ) like Hess (HES), Stone Energy (SGY), and Bonanza Creek Energy (BCEI).

Estimates for 2018

Rystad Energy expects that US oil production could surpass Saudi Arabia and Russia’s oil production in the next 12 months. US oil production could average ~10,020,000 bpd (barrels per day) in 2018, according to the EIA. It will be the highest annual production average ever.

Production cuts and US oil production

OPEC and Russia extended the production cuts until December 2018. Monthly US oil production has risen by 812,000 bpd or 9.2% between January 2017 and October 2017. It offset ~45.1% of the ongoing production cuts.