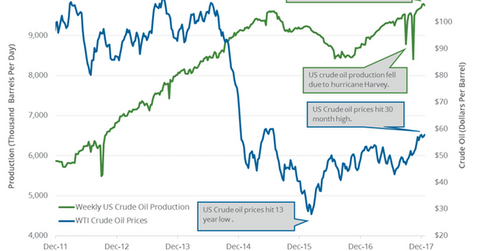

Weekly US Crude Oil Production Fell for the 1st Time since October

US crude oil production declined by 35,000 bpd (barrels per day) or 0.4% to 9,754,000 bpd from December 15 to 22, 2017, per the EIA.

Dec. 29 2017, Updated 5:20 p.m. ET

Weekly US crude oil production

US crude oil production declined by 35,000 bpd (barrels per day) or 0.4% to 9,754,000 bpd from December 15 to 22, 2017, per the EIA. However, production increased by 988,000 bpd or 11.3% from the same period in 2016.

Weekly US crude oil production declined for the first time since October 13. The EIA released data on December 28. News of an unexpected decline in US production supported Brent (BNO) and WTI oil (DWT)(UCO) prices on the same day.

US crude oil production peak and low

US crude oil production hit 9,789,000 bpd (barrels per day) for the week ended December 15, 2017—the highest production level ever. In contrast, production hit 8,428,000 bpd for the week ended July 1, 2016—the lowest production in more than two years.

US crude oil production increased by 1,326,000 bpd or 15.7% from the lows on July 1, 2016. Higher oil (USO)(USL) prices in 2017 compared to 2016 and improving drilling costs led to the increase in US oil production.

Estimates for 2018

Some surveys predict that US production could hit 10,000,000 bpd in the next few months. The EIA estimates that US production could average ~10,020,000 bpd in 2018, which would be the highest annual production average ever.

Higher oil prices in 4Q17 should contribute to higher oil rigs and supplies and favor oil producers (FENY)(IXC) like Carrizo Oil & Gas (CRZO), Parsley Energy (PE), Denbury Resources (DNR), and SM Energy (SM).

Output cuts and US oil production

Major oil producers extended the output cuts until December 2018. US oil production has risen by 808,000 bpd or 9% between January 2017 and December 22, 2017. It has offset ~45% of the production cuts.

Impact

The IEA (International Energy Agency) expects that US oil production will increase by 870,000 bpd in 2018, which will add to non-OPEC supplies. The rise in non-OPEC supplies could partially offset the production cuts in 2018. It would weigh on oil (UCO) prices in 2018.

Next, we’ll cover gasoline inventories, which is also a bearish driver for crude oil in 2018.