OPEC’s Crude Oil Production Hit a 6-Month Low

US crude oil (UWT) (SCO) futures contracts for January delivery fell 0.42% and were trading at $57.38 per barrel at 1:00 AM EST on December 6, 2017.

Dec. 6 2017, Updated 10:15 a.m. ET

Crude oil futures

US crude oil (UWT) (SCO) futures contracts for January delivery fell 0.42% and were trading at $57.38 per barrel at 1:00 AM EST on December 6, 2017. Prices fell ahead of the EIA’s crude oil inventory report. Changes in oil prices impact ETFs like the Energy Select Sector SPDR ETF (XLE) and the Vanguard Energy ETF (VDE). They fell 0.4%, respectively, on December 5, 2017.

Similarly, the E-Mini S&P 500 (SPY) futures contracts for December delivery fell 0.16% to 2,624 at 1:00 AM EST on December 6, 2017.

OPEC’s crude oil production

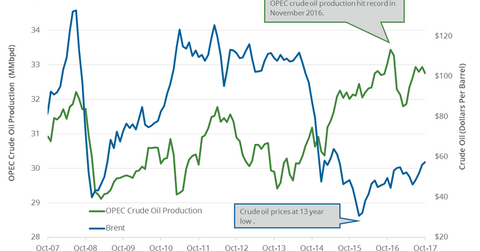

A Reuters survey estimated that OPEC’s crude oil production fell by 300,000 bpd (barrels per day) or 0.9% to 32,480,000 bpd in November 2017—compared to the previous month. It was the lowest level since May 2017. Production fell due to the fall in output from Angola, Iraq, Saudi Arabia, and Venezuela. The decline in OPEC’s production supported oil prices on December 5, 2017. Higher oil prices benefit oil companies’ (IEZ) (XES) earnings like BP (BP), Shell (RDS.A), Whiting Petroleum (WLL), and Newfield Exploration (NFX).

OPEC’s exit strategy

OPEC’s compliance with ongoing production cuts was at 112% in November 2017—compared to 92% in October 2017. On November 30, 2017, OPEC extended the current production cuts until December 2018.

Saudi Arabia is OPEC’s largest oil producer. On December 4, 2017, Saudi Arabia’s oil minister said that OPEC would have a closer analysis of oil market conditions in June 2018. It would help OPEC decide on s smooth exit strategy for the current production cuts.

Impact

Traders will be trackingOPEC’s compliance with the production cuts in 2018. Higher compliance with the production cuts will be the biggest positive driver for oil (SCO) (OIL) prices.

Next, we’ll discuss the biggest negative driver for oil prices.