These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

Dec. 8 2017, Published 10:22 a.m. ET

MLPs with highest EBITDA margin

Midstream companies generally have lower margins than upstream companies, but we have to remember that not all MLPs (master limited partnerships) are midstream companies.

In this series, we’ll look at the top ten MLPs that have the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins and their performance drivers.

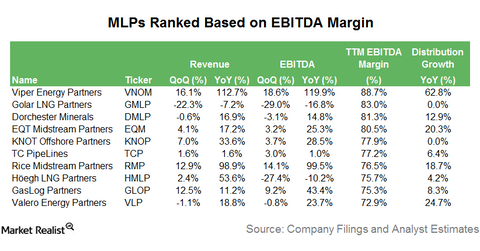

The top ten MLPs ranked in the order of their trailing-12-month EBITDA margins are as follows:

The MLP subsector with highest EBITDA margin

Among the MLPs subsectors, mineral interest MLPs, which own royalty interest in crude oil and natural gas producing assets, have the highest EBITDA margins (~71%). Two out of the top three MLPs are mineral interest MLPs.

Downstream MLPs, which are mostly involved in crude oil refining and refined products marketing, have the lowest EBITDA margins (10%), while the gathering and processing subsector, which has the highest number of MLPs, has an EBITDA margin of ~40%.

The AMLP constituent with highest EBITDA margin

The Alerian MLP ETF (AMLP), which consists of 25 energy MLPs, is an important benchmark for analyzing the performance of MLPs, particularly midstream MLPs. Among the AMLP constituents, EQT Midstream Partners has the highest EBITDA margin, while Plains All American Pipeline (PAA) has the lowest EBITDA margin.

In the next part, we’ll look at Viper Energy Partners’ EBITDA margin.