GasLog Partners LP

Latest GasLog Partners LP News and Updates

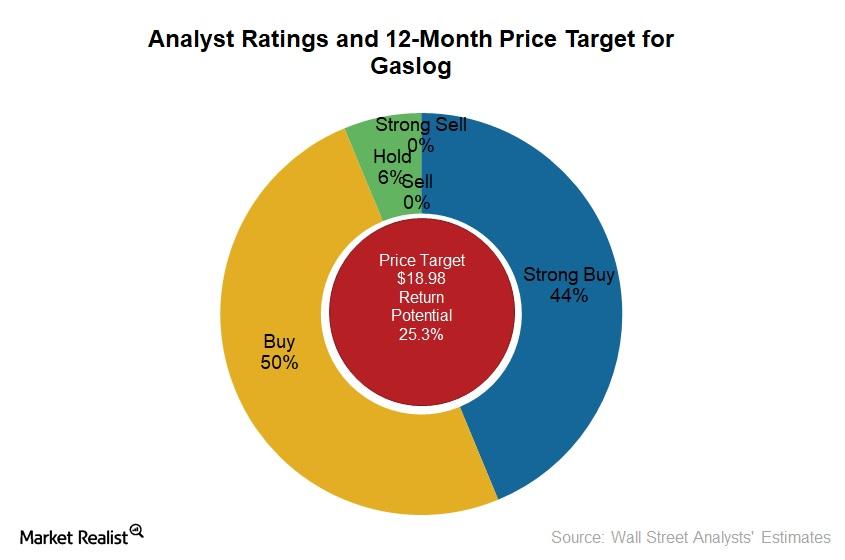

Morgan Stanley Upgrades GasLog

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.”

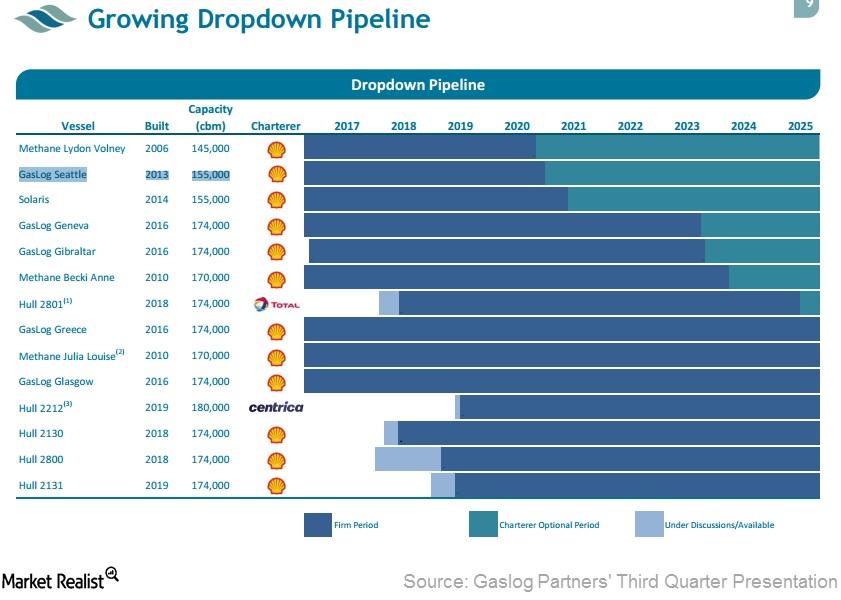

What Are GasLog Partners’ Asset Dropdown and Dropdown Options?

GasLog, GasLog Partners’ general partner (or GP), has entered into a seven-year time charter contract with Total, which will commence in mid-2018.

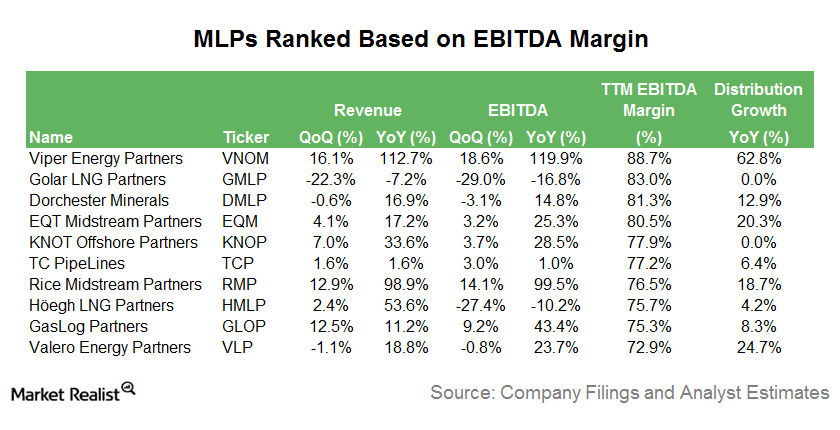

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

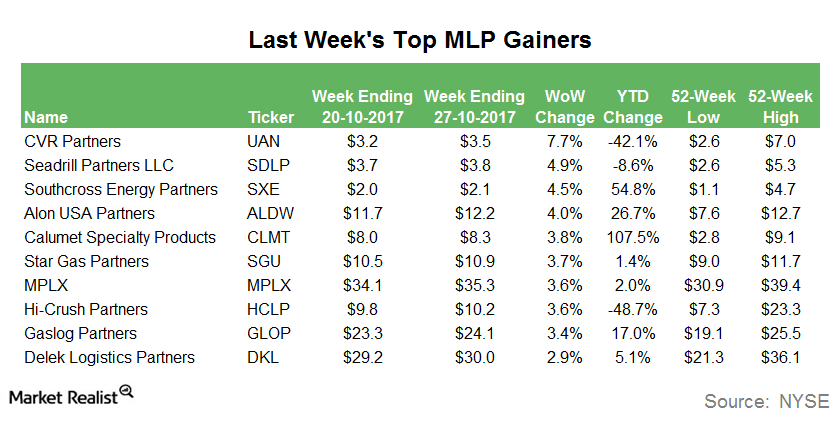

Last Week’s Top MLP Gainers

CVR Partners (UAN), the MLP mainly involved in the production of nitrogen fertilizers, was the top MLP gainer last week. CVR Partners rose 7.7%.