TC Pipelines LP

Latest TC Pipelines LP News and Updates

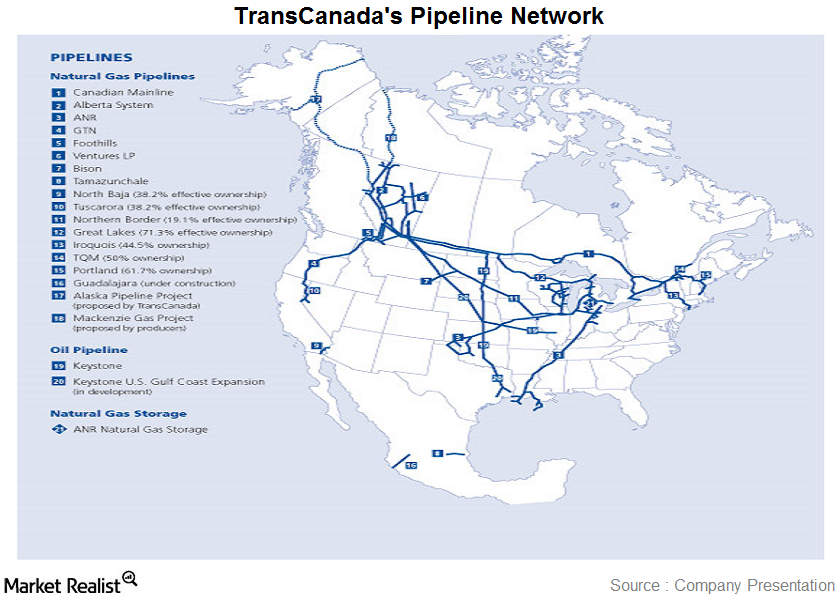

The story behind the Canadian giant—TransCanada Corp.

TransCanada Corporation (TRP) is based in Canada. It’s one of North America’s leading natural gas pipeline network owners. TransCanada also provides natural gas storage services.

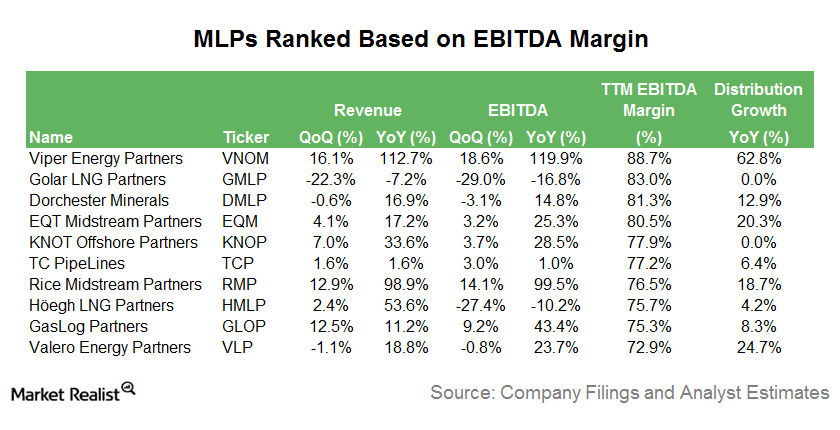

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.