Hoegh LNG Partners LP

Latest Hoegh LNG Partners LP News and Updates

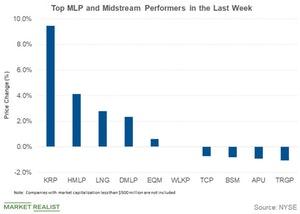

LNG and EQM: Which Midstream Companies Outperformed Last Week?

Cheniere Energy (LNG) was among the top midstream gainers last week. The stock rose 2.8% during the week.

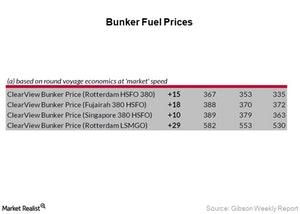

Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

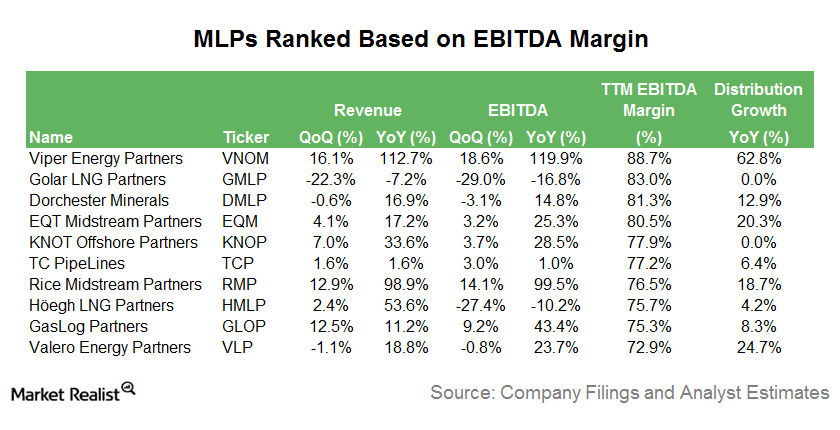

These MLPs Have the Highest Earnings Margins Today

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.