Viper Energy Partners LP

Latest Viper Energy Partners LP News and Updates

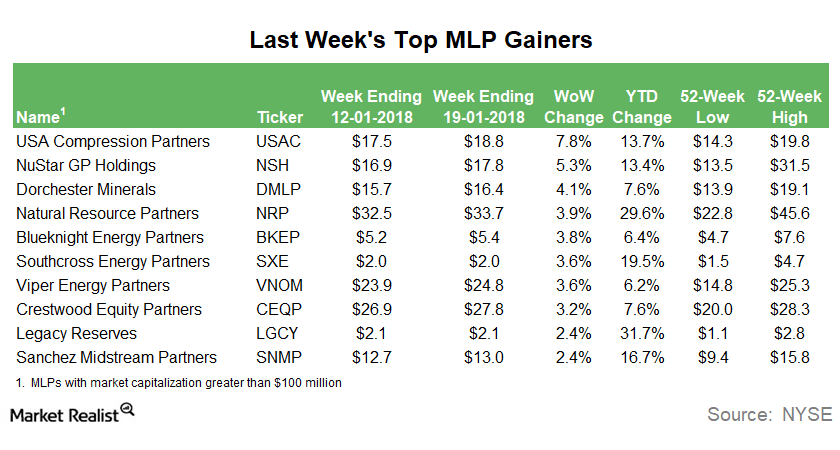

Why USAC Was the Top MLP Last Week

USA Compression Partners (USAC), a midstream MLP involved in natural gas contract compression services, was the top MLP gainer last week with WoW (week-over-week) gains of 7.8%.

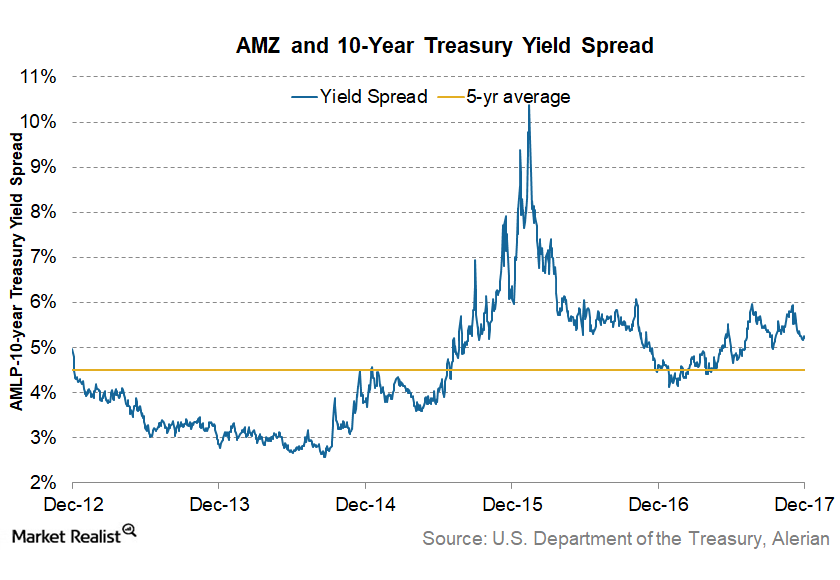

How Do These MLPs Look in 2018?

MLPs had a strong start to the new year. The Alerian MLP Index rose 5% in the first week of 2018.

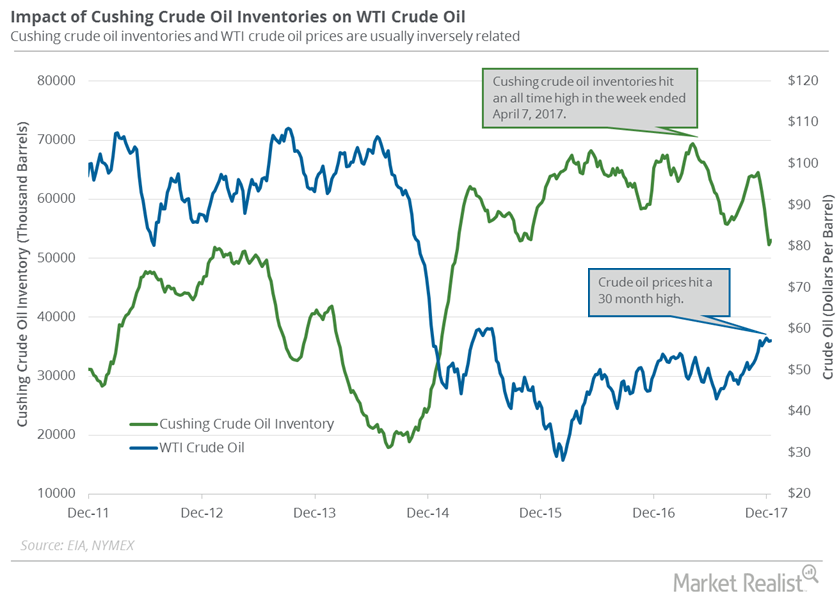

Cushing Inventories Rose for the First Time in Nearly 2 Months

Cushing inventories rose by 754,000 barrels or 1.4% to 52.9 MMbbls (million barrels) on December 8–15, 2017, according to the EIA.

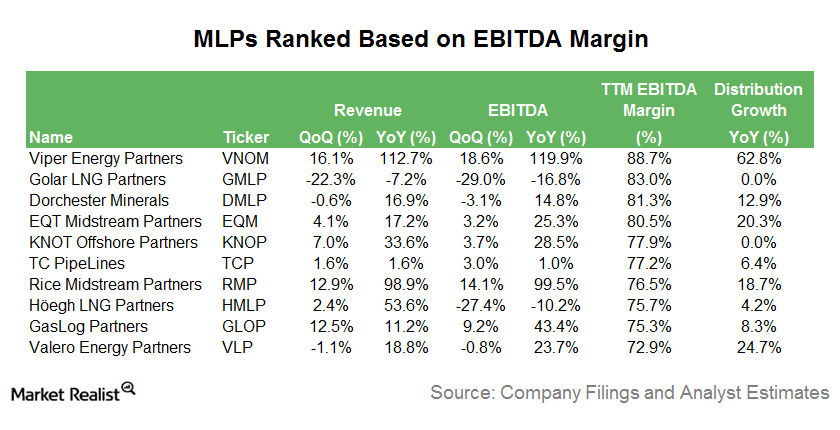

These MLPs Have the Highest Earnings Margins Today

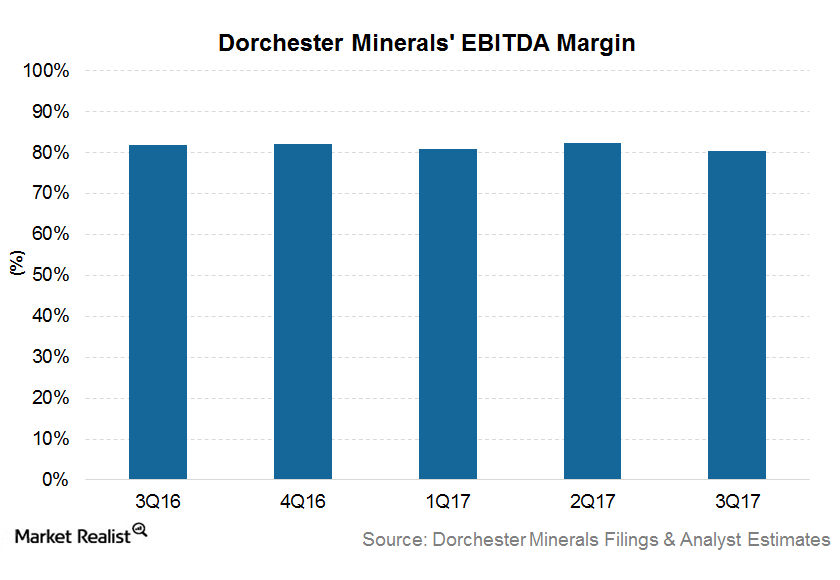

In this series, we’ll assess the performances of the MLPs with the highest EBITDA (earnings before interest, tax, depreciation, and amortization) margins.

Where DMLP’s Earnings Margin Stands among Top MLPs

Dorchester Minerals, a mineral interest MLP (master limited partnership), has the third-best EBITDA margin among MLPs today.