Libya’s Crude Oil Production: Time to Sell Oil Futures?

Libya plans to pump 1.25 million barrels per day of crude oil by December 2017. An increase in Libya’s crude oil production could weigh on oil prices.

Nov. 20 2020, Updated 5:32 p.m. ET

Crude oil futures

December US crude oil (SCO) (USL) futures contracts rose 0.04% and were trading at $51.92 per barrel in electronic exchange at 2:17 AM EST on October 24, 2017. Similarly, December E-Mini S&P 500 (SPY) futures contracts rose 0.05% to 2,564.75 in electronic exchange at 2:17 AM EST on October 24, 2017.

Crude oil (DBO) (USO) prices rose before the American Petroleum Institute’s crude oil inventory report, which will release on October 24, 2017. Wall Street analysts expect that US crude oil inventories fell by 2.5 MMbbls (million barrels) on October 13–20, 2017. A larger-than-expected fall in crude oil inventories could support oil (OIL) (UWT) prices.

Libya’s crude oil production

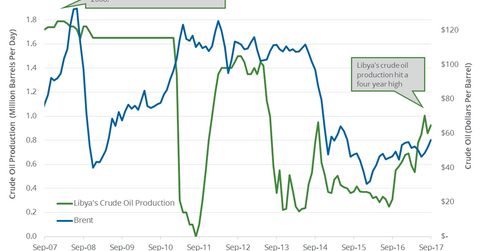

Libya is an OPEC member. The U.S. Energy Information Administration estimates that Libya’s crude oil production rose by 65,000 bpd (barrels per day) to 925,000 bpd in September 2017—compared to August 2017. Production rose 7.5% month-over-month and by 615,000 bpd or 200% year-over-year. Production is near a four-year high. High crude oil production from Libya is bearish for crude oil (BNO) (USL) (DWT) prices. Changes in oil prices impact oil producers (VDE) (IEZ) like Hess (HES), Sanchez Energy (SN), Goodrich Petroleum (GDP), and Devon Energy (DVN).

Production rose due to the restart of the Sharara oilfield in September 2017—the largest oilfield in Libya. Theis oilfield has a capacity of 270,000 bpd, which is equal to 25% of Libya’s crude oil production. It was shut down due to militant attacks on August 19, 2017. The oilfield has been operational in October 2017, which could drive production.

Impact

Libya’s crude oil production hit 1,005,000 bpd in July 2017—the highest level in four years. Libya was exempt from the ongoing output cut deal due to economic problems. Libya’s crude oil production has risen by ~250,000 bpd since January 2017.

Libya plans to pump 1.25 million barrels per day of crude oil by December 2017. An increase in Libya’s crude oil production could weigh on oil (BNO) (USO) prices.

In the next part, we’ll discuss how the Organisation for Economic Cooperation and Development’s crude oil inventories impact oil prices.