Will OPEC Meeting in Vienna Affect Crude Oil Futures?

November US crude oil (UWT) (SCO) (DBO) futures contracts rose 1.6% and closed at $49.3 per barrel on September 20, 2017.

Nov. 20 2020, Updated 11:19 a.m. ET

US crude oil futures

November US crude oil (UWT) (SCO) (DBO) futures contracts rose 1.6% and closed at $49.3 per barrel on September 20, 2017. Prices rose due to a fall in US gasoline and distillate inventories between September 8 and September 15, 2017. The EIA released this data on September 20. The recovery in US refinery demand after Hurricane Harvey and optimism around tightening global crude oil supply and demand also helped oil prices.

US crude oil (USO) (UCO) futures are at four-month highs due to several bullish drivers. Higher crude oil prices have a positive impact on oil and gas producers (XLE) (XOP) (VDE) like Noble Energy (NBL), Chesapeake Energy (CHK), and Chevron (CVX).

OPEC meeting in Vienna

On September 20, 2017, Algeria’s energy minister said that OPEC members will meet in Vienna on Friday, September 22, 2017. The meeting will focus on whether major oil producers should consider longer and deeper production cuts.

OPEC and non-OPEC producers agreed to cut crude oil production by 1.8 MMbpd (million barrels per day) from January 2017 to March 2018 as part of the production cut deal.

Saudi Arabia and Russia are interested in extending the production cut deal. On September 19, 2017, Iraq’s oil minister suggested that the production cut deal could be extended beyond March 2018. Any extension of the production cut deal is bullish for crude oil (UWT) (DWT) prices.

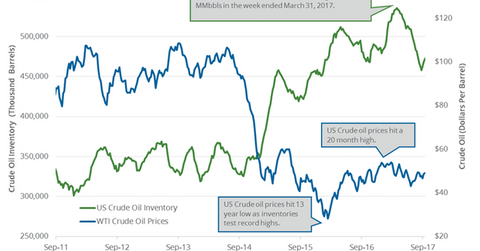

EIA crude oil inventories

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 20, 2017. US crude oil inventories rose for the third straight week.

S&P 500 and Dow Jones hit records

The S&P 500 (SPY) rose 0.01% to 2,508.24 on September 19, 2017. Likewise, the Dow Jones Industrial Average Index (DIA) rose 0.19% to 22,412.59 on September 19, 2017. The S&P 500 and the Dow Jones Industrial Average closed at record levels on September 19, 2017. The IT (XLK) (VGT), healthcare (XLV), and materials (XLB) sectors have been driving the S&P 500 so far in 2017.

Series overview

In this series, we’ll review US crude oil inventories, refinery demand, production, and gasoline and distillate inventories. We’ll start with the US dollar’s impact on crude oil in the next part of the series.