Will Major Oil Producers Extend the Output Cut Deal past March?

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

Sept. 19 2017, Updated 8:09 a.m. ET

Crude oil futures

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

Likewise, E-Mini S&P 500 (SPY) December futures contracts rose 0.24% to 2,503.25 in electronic trading at 2:10 AM EST.

US crude oil prices are near a two-month high. Higher crude oil prices have a positive impact on oil and gas producers like Chevron (CVX), ConocoPhillips (COP), PDC Energy (PDCE), and Sanchez Energy (SN).

Major oil producers’ output cut deal

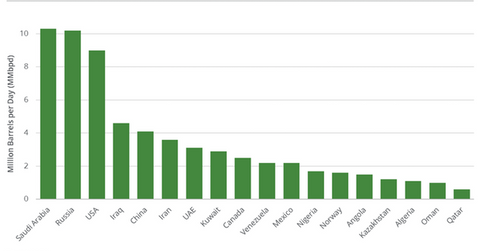

OPEC and non-OPEC producers agreed to cut crude oil production by 1.8 MM bpd from January 2017 to March 2018. The IEA’s (International Energy Agency) latest estimates suggest that global crude oil supply and demand are narrowing.

Major oil producers’ crude oil production in August 2017

The EIA (U.S. Energy Information Administration) estimates that OPEC’s crude oil production fell by 150,000 bpd (barrels per day) to 32.7 MMbpd (million barrels per day) in August 2017 compared with July 2017. Russia’s crude oil production hit a 12-month low to 10.91 MMbpd in August 2017.

Major oil producers’ production cut plans

On Sunday, September 10, Saudi Arabia’s energy minister discussed a possible extension of a production cut deal beyond March 2018 with Venezuela and Kazakhstan. Russia could also support the extension of the production cut deal.

Some traders believe that OPEC needs to extend the production cut deal beyond March 2018, which in turn could help crude oil prices to stay firm. The next OPEC meeting is slated for November 30. The meeting may announce whether the deal will get an extension.