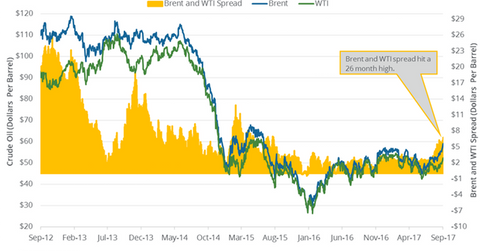

Why the Brent and WTI Crude Oil Spread Hit a 26-Month High

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.

Sept. 26 2017, Published 1:08 p.m. ET

Crude oil prices

November WTI (West Texas Intermediate) crude oil (UWT)(DWT)(DBO) futures contracts fell 0.2% and were trading at $52.12 per barrel in electronic trading at 2:20 AM EST on September 26.

Likewise, E-Mini S&P 500 (SPY) December futures contracts fell 0.1% to 2,494.5 in electronic trading at 2:20 AM EST.

Brent and WTI crude oil spread

Brent (BNO) and US crude oil (USO)(UCO) prices have risen 25% and 18% in the last three months, respectively. The Brent and WTI crude oil spread was at $6.8 per barrel on September 25—the highest level in 26 months. Brent crude oil prices are at their highest level since July 2015.

The major oil producers’ production cut deal has supported crude oil prices since November 2016. It led to a fall in global crude oil inventories, which supported Brent crude oil prices in particular.

On September 25, due to its opposition to the Kurdish referendum, Turkey threatened to block 700,000 bpd (barrels per day) of crude oil flowing through pipelines across its land from Iraq’s Kurdistan region to the outside world. Fears of supply outage pushed Brent crude oil prices substantially higher that day. Rising crude oil imports from China also supported Brent crude oil prices.

However, WTI crude oil’s upside has been capped due to:

- US crude oil production has risen 12% since September 2016.

- US crude oil inventories are 25% above their five-year average. Hurricane Harvey impacted 25% of US refinery crude oil demand.

- Cushing crude oil inventories are also at seasonal highs.

The combination of bullish factors in favor of Brent and bearish factors against WTI has helped push the spread between the two oil benchmarks to a 26-month high.

Brent and WTI crude oil spread: High and lows

The Brent (BNO) and WTI crude oil (SCO)(UWT) spread was at a record $27.8 per barrel in October 2011. Brent crude oil traded at discount of $14.8 per barrel against WTI in September 2008—the lowest in the last 15 years.

Impact

The widening Brent-WTI spread benefits oil refiners (CRAK) in the United States such as Phillips 66 (PSX), Western Refining (WNR), and Northern Tier Energy (NTI). But narrow spreads mean prices for US oil producers (XLE)(VDE) such as Laredo Petroleum (LPI) and Pioneer Natural Resources (PXD) are closer to international crude oil prices.

In the next part of this series, we’ll look at how Iraq’s crude oil production drives oil prices.