US Crude Oil Production Near 4-Week High: Another Bearish Factor

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017.

Sept. 21 2017, Updated 10:00 a.m. ET

US crude oil production

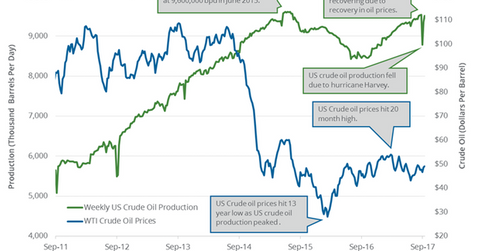

The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 157,000 bpd (barrels per day), or 1.7%, to 9,510,000 bpd between September 8, 2017, and September 15, 2017. In fact, production has risen 998,000 bpd, or 11.7%, from the corresponding period in 2016. US crude oil production has risen in the last two consecutive weeks and is near a four-week high.

High crude oil production has pressured US crude oil (USO) (UCO) (DBO) prices. As a result, US crude oil futures are down 11.8% YTD (year-to-date).

Lower crude oil (UWT) (DWT) prices have a negative impact on oil and gas producers (XES) (IEZ) (PXI) such as SM Energy (SM), ConocoPhillips (COP), and Denbury Resources (DNR). For details on monthly US crude oil production, see US Crude Oil Production Hit a 5-Month Low.

US crude oil production’s peaks and lows

US crude oil production hit a peak of 9.6 MMbpd (million barrels per day) in June 2015. Production rose due to higher crude oil prices between 2011 and 2014, cheaper credit facilities, and technological advancements.

In contrast, crude oil production hit 8.4 MMbpd in July 2016, its lowest level since May 2014. Production fell due to lower crude oil prices in 2015 and higher break-even and production costs of US shale oil producers compared to other producers.

US crude oil production estimates

The EIA estimates that US crude oil production could average 9.3 MMbpd in 2017. The EIA estimates that production would then rise 6.7% to 9.8 MMbpd in 2018. Production averaged 8.9 MMbpd in 2016 and 9.4 MMbpd in 2015.

Impact

US crude oil production could hit a new annual record in 2018. The rise in US crude oil production could offset some of the impact of the major producers’ production cut deal. It could also pressure crude oil (UWT) (DWT) (SCO) prices.

In the next part of this series, we’ll look at US gasoline inventories.