Will Saudi Arabia Remove Excess Oil from the Market?

Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

Nov. 20 2020, Updated 3:55 p.m. ET

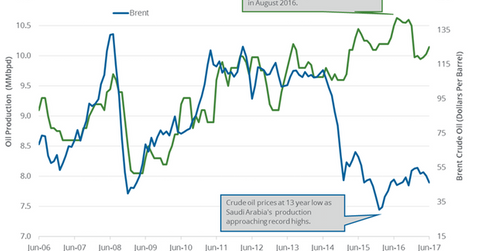

Saudi Arabia’s crude oil production

According to a Reuters survey, Saudi Arabia’s crude oil production fell by 50,000 bpd (barrels per day) to 10.02 MMbpd (million barrels per day) in July 2017.

Saudi Arabia’s crude oil production hit 10.07 MMbpd in June 2017—the highest level in 2017. Production fell due to compliance with OPEC’s production cut deal.

High production from Saudi Arabia is bearish for crude oil (ERY) (ERX) (FXN) prices. Lower crude oil prices have a negative impact on oil and gas producers such as Apache (APA), PDC Energy (PDCE), and Comstock Resources (CRK).

OPEC’s crude oil exports

OPEC’s crude oil exports rose by 370,000 bpd (barrels per day) to 26.11 MMbpd (million barrels per day) in July 2017. Petro-Logistics predicts that OPEC’s crude oil production has risen by 145,000 bpd (barrels per day) to 33 MMbpd in July 2017. High production from OPEC is bearish for crude oil (XLE) (XOP) (USO) prices.

Saudi Arabia’s export plans

Among OPEC members, Saudi Arabia is the largest crude oil producer and exporter. Saudi Arabia is expected to cut exports 10% to North Asian refiners in September 2017 due to OPEC’s production cut deal.

Meanwhile, China’s crude oil imports from the US are expected to rise in 2H17—compared to 1H17. Likewise, India is also expected to import from the US. It suggests that Saudi Arabia might lose its market share due to OPEC’s deal to reduce crude oil production by 1.8 MMbpd from January 2017 to March 2018.

Saudi Arabia is expected to cut crude oil exports to 6.6 MMbpd in August 2017—1 MMbpd lower than the same period in 2016.

Impact

An expectation of a fall in OPEC and Saudi Arabia’s production and exports in August 2017 would support crude oil (IXC) (IYE) prices. Higher crude oil prices have a positive impact on oil producers like PDC Energy and Comstock Resources.

In the next part of this series, we’ll see how Russia’s crude oil production could impact crude oil prices.