OPEC’s Monthly Report Could Pressure Oil Prices

OPEC will release its Monthly Oil Market Report on July 12, 2017. OPEC’s crude oil production rose in June 2017.

Nov. 20 2020, Updated 12:24 p.m. ET

OPEC’s crude oil production

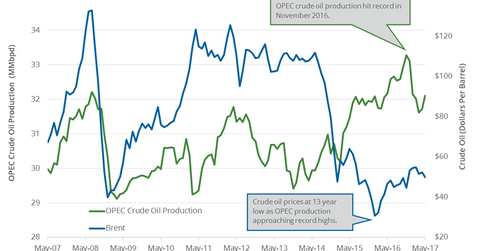

OPEC (Organization of the Petroleum Exporting Countries) will release its Monthly Oil Market Report on July 12, 2017. A Reuters and Bloomberg survey shows that OPEC’s crude oil production rose in June 2017. According to Reuters’ survey, OPEC’s crude oil production is the highest so far in 2017. A rise in crude oil production is bearish for crude oil (XES) (VDE) (XLE) prices. If OPEC’s monthly report shows a rise in OPEC’s crude oil production in June 2017, it would pressure oil prices. US crude oil prices have fallen ~18% in the last three months.

Lower crude oil prices have a negative impact on crude oil producers’ revenues such as SM Energy (SM), Sanchez Energy (SN), Swift Energy (SFY), and Continental Resources (CLR).

OPEC members’ production

According to Reuters’ surveys, OPEC members’ crude oil production figures for June 2017 are as follows:

- Algeria – flat at 1.1 MMbpd (million barrels per day)

- Angola – a rise of 40,000 bpd (barrels per day) to 1.7 MMbpd

- Iran – a rise of 10,000 bpd to 3.8 MMbpd

- Iraq – a fall of 30,000 bpd to at 4.4 MMbpd

- Kuwait – a rise of 10,000 bpd to 2.7 MMbpd

- Saudi Arabia – a rise of 40,000 bpd to 10 MMbpd

- United Arab Emirates – a rise of 10,000 bpd to 2.9 MMbpd

- Venezuela – a fall of 10,000 bpd to 2 MMbpd

Production cut deal

OPEC and Russia entered into a production cut deal on May 25, 2017, to reduce crude oil production by 1.8 MMbpd from January 2017 to March 2018. A rise in crude oil production from Nigeria, Libya, and the US could offset the production cut deal. As a result, OPEC might cap Nigeria and Libya’s crude oil production. To learn more, read the previous part in the series. Changes in production impact crude oil (USL) (PXI) (ERY) prices.

In the next part, we’ll discuss some crude oil price forecasts.