Crude Oil Prices Rise: Is It Time for a Collapse?

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high.

Nov. 20 2020, Updated 2:55 p.m. ET

US crude oil prices

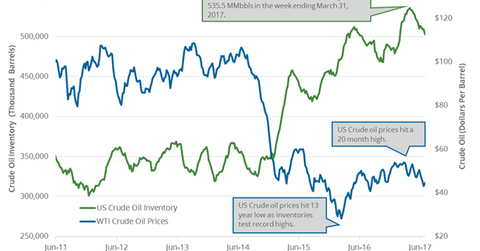

WTI (West Texas Intermediate) crude oil (XLE) (USO) (RYE) futures contracts for August delivery rose 0.8% and settled at $45.53 per barrel on July 6, 2017. Brent crude oil futures also rose 0.6% and closed at $48.11 per barrel on July 6, 2017.

Prices rose due to the following:

- a larger-than-expected fall in US crude oil inventories on June 23–30, 2017

- a larger-than-expected fall in US gasoline inventories last week

- an unexpected fall in US distillate inventories on June 23–30, 2017

- short covering

WTI crude oil prices have risen 9.4% since June 21, 2017. Brent and US crude oil prices are near a three-week high due to the following:

- fall in monthly US crude oil production

- a rise in US gasoline demand

- near-record S&P 500 (SPY) (SPX-INDEX)

- US dollar (UUP) at an eight-month low

For more on bullish drivers, read Crude Oil Futures Rose for the Seventh Straight Day.

Higher crude oil prices have a positive impact on oil and gas producers’ earnings like ExxonMobil (XOM), Hess (HES), and Bonanza Creek Energy (BCEI).

However, Brent and WTI crude oil prices fell ~4% on July 5, 2017, due to the rise in OPEC’s crude oil production and exports in June 2017. Brent and WTI crude oil prices have fallen ~20% year-to-date. Prices entered into the bear market on June 21, 2017. Prices might not sustain the recent rally due to the following:

- a rise in weekly US crude oil production on June 23-30, 2017

- Russia might not support deeper or longer production cuts

- expectation of slowing crude oil imports and demand from China, India, and Japan in the coming months

- a rise in Libya, Nigeria, and Iran’s crude oil production

- high crude oil storage in tankers

- a rise in US crude oil exports

- rising concerns about whether the production cut deal will remove excess crude oil from the market

Key moving averages and long-term fundamentals are still bearish for crude oil prices, which suggests that prices could trade lower.

In this series, we’ll discuss crude oil drivers in more detail.