Will Libya and Iran Swing Crude Oil Prices?

Market surveys project that Libya’s crude oil production is near 1 MMbpd—the highest level in three years. High production could pressure crude oil prices.

June 30 2017, Published 8:15 a.m. ET

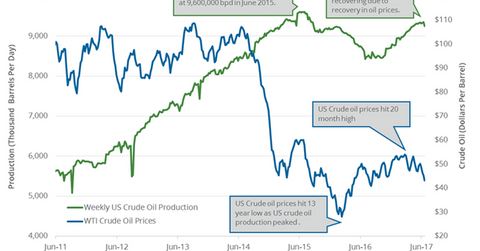

US crude oil prices

WTI (West Texas Intermediate) crude oil (XOP) (XLE) (USO) futures contracts for August delivery rose 0.4% and settled at $44.93 per barrel on June 29, 2017. Prices are trading near a two-week high due to lower US crude oil production last week. Crude oil prices rose for the sixth consecutive session.

Higher crude oil prices have a positive impact on oil producers like ConocoPhillips (COP), Bill Barrett (BBG), and Stone Energy (SGY).

Crude oil futures

US crude (RYE) (VDE) futures have risen more than 5% since June 21, 2017. However, Brent and US crude of futures have fallen ~20% YTD (year-to-date). Read Crude Oil Prices Rose for the Fifth Day: Is It a Bear Trap? for more on bullish and bearish drivers.

Iran’s crude oil exports

Market surveys project that Iran’s crude oil exports could fall to 1.86 MMbpd (million barrels per day) in July 2017. The expectation of a fall in imports from Europe could lead to a fall in exports. A fall in exports suggests weak demand, which could pressure oil prices.

Libya’s crude oil production

Market surveys project that Libya’s crude oil production is near 1 MMbpd—the highest level in three years. High production from Libya could also pressure crude oil prices.

Fundamental drivers suggest that prices could trade lower or be range bound next week. August US crude oil futures are below their 20-day, 50-day, 100-day, and 200-day moving averages of $45.14, $47.65, $50.16, $51.65 per barrel, respectively, as of June 29, 2017. It also suggests that prices could trade lower in the short term. For more on crude oil’s price forecast, read Hedge Funds’ Net Long Bullish Positions Hit a 10-Month Low.

In the next part, we’ll look at NYMEX natural gas futures.