US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

June 1 2017, Published 9:35 a.m. ET

API’s gasoline inventories

The API (American Petroleum Institute) released its weekly crude oil inventory report on May 31, 2017. The API estimated that US gasoline inventories fell by 1.72 MMbbls (million barrels) on May 19–26, 2017. However, US gasoline prices fell 1.6% to $1.61 per gallon despite the fall in US gasoline on May 31, 2017. US distillate inventories rose by 0.1 MMbbls on May 19–26, 2017. Changes in gasoline and distillate inventories impact gasoline and crude oil (ERY) (ERX) (SCO) prices. For more on crude oil prices, read Part 1 of this series.

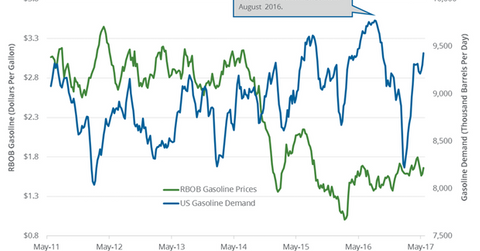

US gasoline demand

The EIA (U.S. Energy Information Administration) estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017. US gasoline demand rose 1.3% for the week ending May 19, 2017—compared to the previous week. However, gasoline demand fell 1.7% compared to the same period in 2016.

The increase in gasoline demand is bullish for gasoline and crude oil (IXC) (IYE) (USL) prices. Higher gasoline and crude oil prices have a positive impact on refiners and oil producers’ earnings like Phillips 66 (PSX), Tesoro (TSO), Valero (VLO), PDC Energy (PDCE), and Cobalt International Energy (CIE).

US gasoline consumption estimates for 2017

The EIA estimates that US gasoline consumption will average 9,330,000 bpd 2017. US gasoline consumption averaged 9,330,000 bpd and 9,180,000 bpd in 2016 and 2015, respectively. Market surveys project a rise in US travelers to hit a record this summer. It would impact gasoline demand in 2017. High gasoline consumption in 2017 could have a positive impact on gasoline and crude oil prices.

In the last part of this series, we’ll take a look at Asia’s crude oil imports and demand in 2017.