Traders Focus on the API and EIA’s Crude Oil Inventories

On May 16, 2017, the API released its weekly crude oil inventory report. US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017.

Nov. 20 2020, Updated 4:20 p.m. ET

API’s crude oil inventories

On May 16, 2017, the API (American Petroleum Institute) released its weekly crude oil inventory report. It reported that US crude oil inventories rose by 0.8 MMbbls (million barrels) on May 5–12, 2017. The surprise rise in crude oil inventories pressured US crude oil (ERY) (SCO) (ERX) prices in post-settlement trade on May 16, 2017. However, prices are trading near a three-week high.

Higher crude oil prices have a positive impact on oil and gas producers’ earnings like Hess (HES), Denbury Resources (DNR), Stone Energy (SGY), and Matador Resources (MTDR).

The API added that Cushing crude oil inventories fell by 0.5 MMbbls on May 5–12, 2017. For more on crude oil prices and drivers, read Part 1 and 2 of this series.

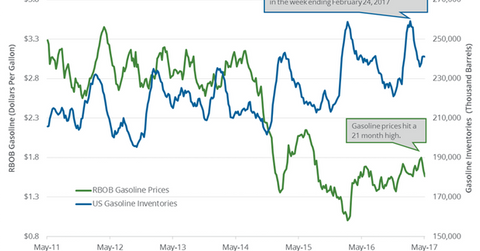

API’s gasoline inventories

The API estimated that US gasoline inventories fell by 1.88 MMbbls on May 5–12, 2017. However, US distillate inventories rose by 1.8 MMbbls for the same period. Moves in refined product inventories impact gasoline and crude oil (FXN) (IXC) (RYE) (IYE) prices.

EIA’s crude oil inventories

The API’s report will be followed by the EIA’s (U.S. Energy Information Administration) weekly crude oil inventory report on May 17, 2017. The data will be for the week ending May 12, 2017. For the week ending May 5, 2017, the EIA reported that US crude oil inventories fell by 5.2 MMbbls to 522.5 MMbbls. Read US Crude Oil Inventories Post Biggest Draw since December for more details on US crude oil and gasoline inventories.

Impact of US crude oil inventories

A market survey estimates that US crude oil inventories would have fallen by 2.3 MMbbls on May 5–12, 2017. If the EIA reports a surprise build like the API, it could pressure oil prices. It could overshadow OPEC’s output cut deal in the short term.

In the next part of this series, we’ll take a look at gasoline demand. We’ll discuss how it impacts gasoline and crude oil prices.