A Look at India’s Trade Gap and Its Economic Impact

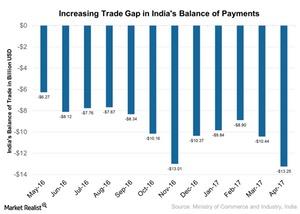

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap.

May 24 2017, Updated 7:37 a.m. ET

Trade balance in India

The trade performance of any country can be measured in terms of its imports, exports, trade balance, total trade, and its growth over the years. India relies less on other countries than do its emerging market (EWZ) (FXI) peers. The country’s export performance has also been steadily increasing over the last few years. Despite these favorable factors, India’s trade balance (EPI) (PIN) is negative.

The chart below shows India’s trade balance over the last year:

India’s trade gap in 2017

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap. Due to a rise in oil and gold imports, it recorded the highest deficit since November 2014.

India’s total imports increased 49.1% on a year-over-year basis to ~$37.9 billion, boosted by a 30.1% rise in oil imports and a 211.4% increase in gold. Exports rose 19.8% to $24.6 billion. The export of gems and jewelry (excluding petroleum) rose 17% in April 2017.

Growing imports

India has recorded sustained trade deficits in the last three decades mainly due to the high growth of imports, particularly of crude oil (USO), gold (GLD), and silver (SLV). The biggest trade deficits were recorded with China, Saudi Arabia, Iraq, Switzerland, and Kuwait.

India’s trade deficit was around 9%–10% of its GDP through 2015. Imports of oil, petroleum products, gold, and silver accounted for more than 45% of India’s total imports through April 2017. Given the current global protectionist scenario, a high trade deficit could create pressure on the rupee (INDA).

In our view, this could impact the cost competitiveness of import-dependent exports in India (SCIF) (SMIN). The relatively inelastic nature of demand and an increase in global prices of commodities (USO) could contribute to increased import costs, leading to an increased fiscal deficit for India (INDA) (INDL). The inelastic demand and expensive imports are expected to result in a high value of imports.

India’s increasing demand for gold and oil could drive the performance of the respective ETFs to some extent. The SPDR Gold Trust ETF (GLD) has gained about 10% so far in 2017.

In our next article, we’ll look at India’s increased consumption and its impact the country’s economy.