Market Vectors® India Small-Cap ETF

Latest Market Vectors® India Small-Cap ETF News and Updates

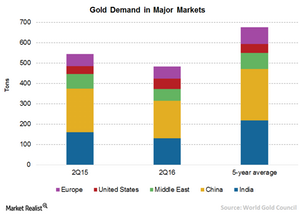

The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

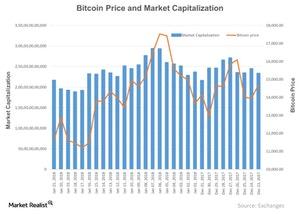

How Is Bitcoin Faring after Last Week’s Slump?

Investors (SPX-INDEX) around the world looked to gold (GLD) (IAU) for the rescue during the slump in bitcoin prices.

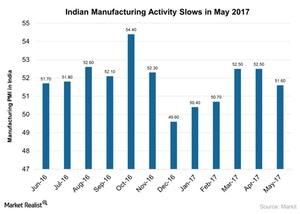

Why India’s Manufacturing Lost Momentum in May

Manufacturing activity in India lost momentum in May 2017, with the India Manufacturing PMI (purchasing managers’ index) recording a decline.

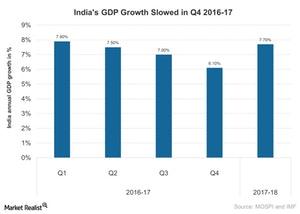

What Happened to Growth in India in Fiscal 4Q16

Economic growth in India (INDA) slowed during the country’s fiscal 4Q16 (January 2017–March 2017), revealing the impact of demonetization.

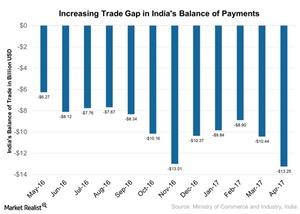

A Look at India’s Trade Gap and Its Economic Impact

India’s trade gap increased 173.5% on a year-over-year basis to ~$13.3 billion in April 2017, beating the market’s expectations of an ~$12.8 billion gap.

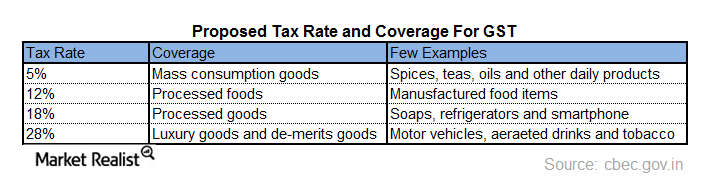

How GST Bill Could Help Investment Scenario in 2017

The implementation of the Goods and Service Tax (or GST) in India is expected to begin on July 1, 2017.

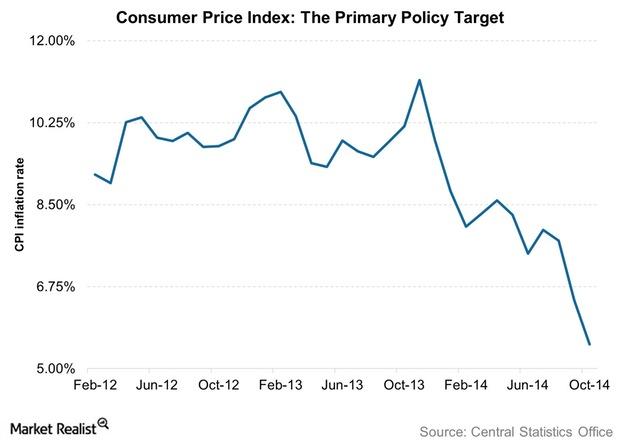

Must-know: India’s monetary policy

The RBI is India’s central bank. It used to announce its monetary policy twice in a financial year. In India, a financial year begins in April and ends in March the next year.