Will Russia’s Oil Production Fall in the Coming Months?

Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

Nov. 20 2020, Updated 3:31 p.m. ET

Russia’s oil production

Russia is the largest crude oil producer in the world. Russia’s Energy Ministry reported that its oil production fell in the first half of April 2017 due to major producers’ production cut deal.

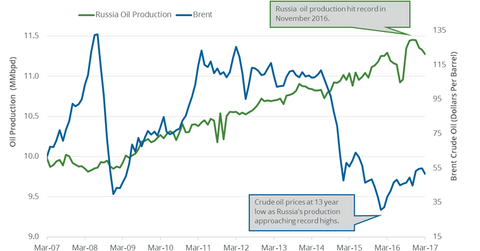

The EIA (U.S. Energy Information Administration) estimates that Russia’s oil production fell by 58,000 bpd (barrels per day) to 11.27 MMbpd (million barrels per day) in March 2017—compared to February 2017. Production fell 0.5% month-over-month and 0.2% YoY (year-over-year). Russia’s oil production fell by ~177,000 bpd (barrels per day) from its peak in November 2016 due to major producers’ production cut deal. Russia plans to cut its production by 300,000 bpd by the end of April 2017 as part of the deal. Higher compliance by Russia with major producers’ deal is bullish for crude oil (DIG) (FENY) (RYE) (SCO) prices.

Higher crude oil prices have a positive impact on crude oil and gas producers’ earnings like Contango Oil & Gas (MCF), Denbury Resources (DNR), Occidental Petroleum (OXY), and Hess (HES). For more on crude oil prices, read Part 1 of the series.

Russia’s crude oil production estimates in 2017

Russia’s crude oil production peaked at 11.41 MMbpd during the Soviet Era in 1988. Russia’s crude oil production averaged ~10.97 MMbpd in 2016—the highest level in the last 30 years. Market surveys estimate that Russia’s crude oil production will rise by 170,000 bpd to average 11.14 MMbpd in 2017. The EIA estimates that Russia’s crude oil and other liquid production will average 11.25 MMbpd and 11.28 MMbpd in 2017 and 2018, respectively.

Impact on crude oil prices

On April 7, 2017, Russia’s energy minister said that he would talk to oil producers about extending major producers’ production cut deal in 2H17. Higher compliance by Russia with major producers’ production cut deal could support crude oil (IEZ) (XES) prices in 2017.

Next, we’ll analyze Iran’s crude oil production.