Will the EIA’s Crude Oil Inventories Support Crude Oil Bulls?

On April 18, 2017, the API released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 0.84 MMbbls from April 7–14.

Nov. 20 2020, Updated 1:04 p.m. ET

API’s crude oil inventories

On April 18, 2017, the API (American Petroleum Institute) released its weekly crude oil inventory report. It reported that US crude oil inventories fell by 0.84 MMbbls (million barrels) from April 7–14, 2017. The less-than-expected fall in crude oil inventories pressured US crude oil (DIG) (FENY) (ERY) prices in post-settlement trade on April 18, 2017. Prices are trading near a two-week low.

Lower crude oil prices have a negative impact on oil and gas producers’ earnings like Continental Resources (CLR), Comstock Resources (CRK), Hess (HES), and Carrizo Oil & Gas (CRZO).

API data showed a cumulative build of ~37 MMbbls in the last 16 weeks. The API added that Cushing crude oil inventories fell by 0.67 MMbbls from April 7–14, 2017. For more on crude oil prices and its drivers, read Part 1 and 2 of this series.

EIA’s crude oil inventories

The API’s report will be followed by the EIA’s (U.S. Energy Information Administration) weekly crude oil inventory report on April 19, 2017. The data will be for the week ending April 14, 2017.

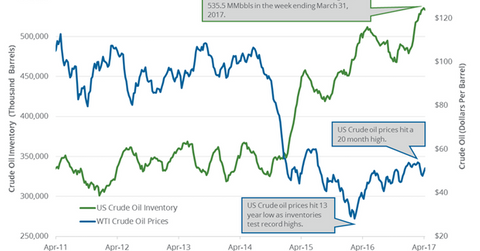

For the week ending April 7, 2017, the EIA reported that US crude oil inventories fell by 2.1 MMbbls (million barrels) to 533.4 MMbbls. Read US Crude Oil Inventories Slip from All-Time High for more information.

Impact of US crude oil inventories

A Bloomberg survey estimates that US crude oil inventories would have fallen by 1.4 MMbbls from April 7–14, 2017. If the EIA reports a larger-than-expected fall in inventories, it would support crude oil (USO) (XLE) (XOP) prices. In contrast, if it reports a surprise build, it could pressure oil prices. It could overshadow OPEC’s output cut deal in the short term.

In the next part of this series, we’ll see how gasoline inventories impact crude oil prices.