Will Crude Oil Prices Hit a New High?

US WTI crude oil prices were at $54.45 per barrel on February 23—the highest level since June 2015. As of April 10, prices were 2.5% below their high.

Nov. 20 2020, Updated 12:59 p.m. ET

Crude oil prices and US stock exchanges

WTI (West Texas Intermediate) crude oil (VDE) (RYE) (IXC) futures for May delivery are at a one-month high as of April 11, 2017. So far, crude oil prices and broader markets such as the S&P 500 (SPY) (SPX-INDEX) are diverging in 2017. SPY has risen 5.3% YTD (year-to-date). However, crude oil prices have fallen ~5.3% YTD. Meanwhile, US crude oil prices have risen ~14% in the last 12 months. SPY rose ~15.1% during the same period. So, bullish momentum in the US stock market could partially support oil prices. For more on crude oil prices, read Part 1 of this series.

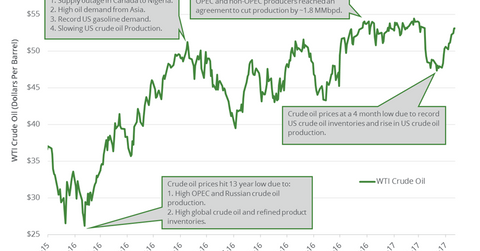

Crude oil’s highs in the last 15 months

US WTI crude oil prices settled at $54.45 per barrel on February 23, 2017—the highest level since June 2015. As of April 10, 2017, crude oil prices were 2.5% below their high.

Key bullish drivers for crude oil in 2017

- possible extension of major oil producers’ production cut deal

- rise in US gasoline demand

- rise in India and China’s crude oil imports and demand

Crude oil’s lows in the last 15 months

US crude oil settled at $26.21 per barrel on February 11, 2016. Crude oil prices hit a 13-year low due to the following factors:

- record US crude oil production in 2015

- record OPEC crude oil production

- record Russian oil production

- record global crude oil and high refined product inventories

As of April 10, 2017, crude oil prices have risen 102.5% from their 2016 lows. Higher crude oil (IYE) (FXN) (SCO) prices have a positive impact on oil producers’ earnings such as Continental Resources (CLR), Matador Resources (MTDR), and SM Energy (SM).

Key bearish drivers for crude oil in 2017

- rise in US crude oil rigs to a 19-month high

- record US crude oil inventories

- rise in US crude oil production

- near-record OECD crude oil inventories

- expectation of a rise in crude oil production from Iran

Crude oil price forecasts

Crude oil prices’ upside could be limited due to the factors mentioned above. Prices are trading above their 200-day moving averages. It suggests that prices could break the 2017 highs. However, Russia’s central bank expects that Brent crude oil prices could fall as low as $40 per barrel by the end of 2017 if OPEC doesn’t extend major producers’ production cut deal in 2H17. For more on crude oil price forecasts, read the last part of the series.

In the next part of the series, we’ll look at how Cushing crude oil inventories impact crude oil prices.