Iraq’s Crude Oil Production: More Pain for Crude Oil Bears

The EIA estimates that Iraq’s crude oil production fell by 115,000 bpd (barrels per day) to 4.42 MMbpd in February 2017—compared to the previous month.

March 21 2017, Published 8:56 a.m. ET

Iraq’s crude oil production

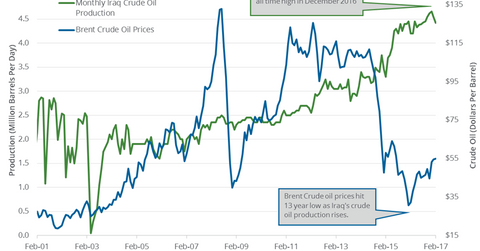

Iraq is OPEC’s (Organization of the Petroleum Exporting Countries) second-largest crude oil producer after Saudi Arabia. The EIA (U.S. Energy Information Administration) estimates that Iraq’s crude oil production fell by 115,000 bpd (barrels per day) to 4.42 MMbpd (million barrels per day) in February 2017—compared to the previous month. Production fell 2.5% month-over-month and 5.4% year-over-year. Production fell due to major producers’ production cut deal.

The fall in production from Iraq could support crude oil (VDE) (FXN) (FENY) (UCO) prices. Higher oil prices benefit Middle East oil producers like Iraq National Oil Company, Saudi Aramco, and Oman Oil Company. They also impact US oil and gas exploration and production companies like ConocoPhillips (COP), PDC Energy (PDCE), Cobalt International Energy (CIE), and Continental Resources (CLR).

Iraq’s crude oil exports

Bloomberg surveys estimate that Iraq produced 4.57 MMbpd of crude oil in February 2017. Iraq’s crude oil exports were at 3.87 MMbpd in February 2017 from its northern and southern ports. Iraq’s Ministry of Oil reported that the revenue from crude oil accounts for 95% of Iraq’s budget. Read How Are Oil Prices Squeezing OPEC Members’ Budgets? to learn more. So, Iran will be ramping up production over the long term after major producers’ production cut deal expires.

Iraq’s crude oil production strategy

Iraq’s crude oil production hit an all-time high of 4.66 MMbpd in December 2016. The country plans to produce more oil to fight militants. The International Energy Agency estimates that Iraq’s crude oil production will rise to 5.4 MMbpd by 2022, which is much higher than previous estimates of 4.6 MMbpd by 2021.

Expectations of a rise in crude oil production from Iraq will have a negative impact on crude oil (ERY) (ERX) (PXI) prices in the oversupplied market.

Next, we’ll analyze OECD’s crude oil inventories.