Will the Crude Oil Supply and Demand Gap Narrow by Early 2017?

The IEA forecast that the global crude oil supply and demand gap would decline to 200,000 bpd in 2H16—compared to 1.5 MMbpd in 1H16.

Nov. 20 2020, Updated 1:40 p.m. ET

IEA’s forecast

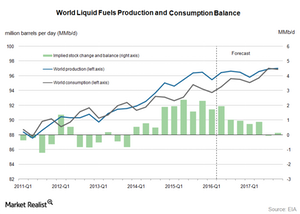

The IEA (International Energy Agency) forecast that the global crude oil supply and demand gap would decline to 200,000 bpd (barrels per day) in 2H16—compared to 1.5 MMbpd (million barrels per day) in 1H16. Slowing non-OPEC (Organization of the Petroleum Exporting Countries) production is the key driver of the decline in the global crude oversupply. To learn more on non-OPEC crude oil production, read the third part of the series. The major decline in production would be driven by the US. To learn more about US crude oil production, read US Crude Oil Production Hit the Lowest Level since October 2014.

EIA and OPEC’s forecast

The EIA (U.S. Energy Information Administration) reported that the global crude oil supply and demand gap averaged 1.8 MMbpd in 1H16. It’s expected to decline to 1 MMbpd in 2H16. In its monthly report, OPEC stated that the global crude oil supply and demand gap averaged 2.6 MMbpd in 1Q16.

Impact of the crude oil supply and demand gap

The reports from the EIA, IEA, and OPEC show that crude oil oversupply will exist in 2016. However, it might narrow down in 2017. Narrowing supply and demand will benefit crude oil prices. High crude oil prices benefit upstream players like Halcon Resources (HK), Matador Resources (MTDR), SM Energy (SM), Cimarex (XEC), Denbury Resources (DNR), and Goodrich Petroleum (GDP). However, OPEC’s report added that there are over 3 billion barrels of crude oil stocks. This would limit the upside for crude oil prices.

The volatility in crude oil prices impacts ETFs and ETNs like the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the Direxion Daily Energy Bull 3x Shares ETF (ERX), the Guggenheim S&P 500 Equal Weight Energy (RYE), the iShares U.S. Oil Equipment & Services ETF (IEZ), and the VelocityShares 3x Inverse Crude Oil ETN (DWTI).

Read the next part of this series to learn more about the latest crude oil price forecast.