Why the T. Rowe Price Blue Chip Growth Fund Has Had a Rough 2016

TRBCX has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD period among the 12 funds in this review.

Oct. 24 2016, Updated 5:04 p.m. ET

TRBCX: performance evaluation

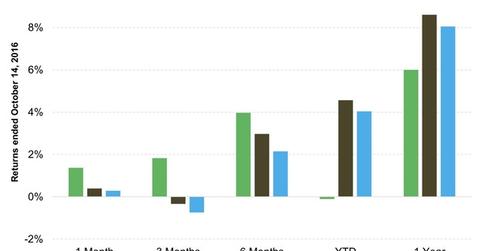

The T. Rowe Price Blue Chip Growth Fund (TRBCX) has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD (year-to-date) period in the group of 12 funds we’ve chosen for this review. There has been some improvement in its performance in the past six months, but TRBCX has not significantly improved in performance in 2016. We have graphed its performance against two ETFs: the iShares S&P 500 Growth ETF (IVW) and the iShares Russell 1000 Growth ETF (IWF).

Let’s look at what has contributed to this poor YTD performance in 2016.

Contribution to returns

TRBCX is one of only three funds to have posted negative point-to-point returns this year as of October 14. Healthcare has been primarily responsible for driving down returns of the fund into negative territory. Alexion Pharmaceuticals (ALXN) is the biggest negative contributor to the fund’s returns. Valeant Pharmaceuticals (VRX) and Allergan (AGN), among others, have worsened the returns from the sector. However, some of the sector’s negative contributions have been reduced by Danaher (DHR), Intuitive Surgical (ISRG), and UnitedHealth Group (UNH).

Industrials are a distant second to healthcare in terms of negative contributions. Airlines have hurt the sector, with American Airlines Group (AAL), United Continental Holdings (UAL), and Boeing (BA) driving down sectoral returns. Canadian Pacific Railway (CP) and FedEx (FDX) have been able to reduce some of the negative contributions, however.

Notably, the tech and consumer discretionary sectors have done the most to reduce the overall negative performances across the fund. Facebook (FB) has led the tech sector and has had help from Tencent Holdings (TCEHY) and Alibaba (BABA). Meanwhile, Amazon.com (AMZN) has spearheaded positive contributions from the discretionary sector with the Priceline Group (PCLN) playing a major role as well. Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises (RCL) have dragged on the sector, however.

Investor takeaways

Disappointing contributions from the tech sector have kept the returns of TRBCX in negative territory so far in 2016. Although the sector has been the highest positive contributor, it has barely beaten the tech stocks in the passively managed SPDR S&P 500 ETF Trust (SPY). The fund manager’s stock picks from consumer discretionary and financials have done much better. But given the fund’s track record, some patience by existing investors could be fruitful.

In the next part of this series, we’ll take a look at the Invesco American Franchise Fund Class A (VAFAX).