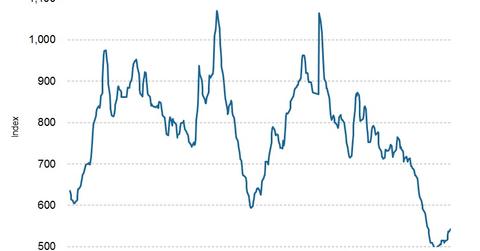

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.

Sept. 14 2016, Published 2:42 p.m. ET

Baltic Dirty Tanker Index

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week. The index rose on four days out of five.

The BDTI tracks shipping rates for the transportation of crude oil (DBO) on representative routes. Researchers and analysts follow this index to assess companies’ revenue and earnings potential.

In Week 36, the index was lower than last year’s level. On average, the index was 17% lower than in the same period in 2015. Because the crude tanker business is seasonal, it’s important to look at its year-over-year performance.

Stock performance

Week 36 was a good week for crude tanker investors. Almost all of the crude tanker stocks ended in positive territory. Below are the stock returns of tanker companies for the week ended September 9, 2016, compared to their prices the week before:

- Gener8 Maritime (GNRT) rose 20%

- Teekay Tankers (TNK) rose 3%

- Nordic American Tankers (NAT), Navios Maritime Partners (NAP), DHT Holdings (DHT), and Euronav (EURN) all rose 2%

- Tsakos Energy Navigation (TNP) gave a 0% return

- Frontline (FRO) fell 2%

Shipping companies account for 19.7% of the Guggenheim Shipping ETF (SEA). SEA rose 2% during Week 36. If you’re interested in broad exposure to the industrials sector, you can invest in the SPDR Dow Jones Industrial Average ETF (DIA).

Series focus

We looked at tanker stock performances in Week 36. Next, we’ll see which tanker performed better during the week. We’ll also look at the cost side of the tanker industry by reviewing bunker fuel costs. Finally, we’ll see how analysts’ sentiments changed in Week 36.