Navios Maritime Midstream Partners LP

Latest Navios Maritime Midstream Partners LP News and Updates

Crude Tanker Stocks and the BDTI Index in Week 39

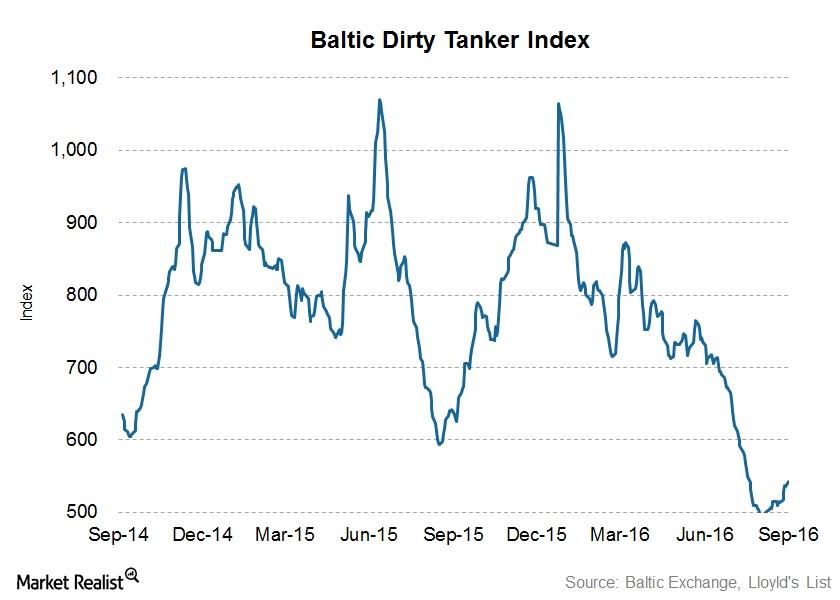

In week 39, the week ending September 29, the BDTI rose to 776 from 772. In week 38, the index rose by 28 points. It rose for the fifth consecutive week.

China’s June Data Impact the Crude Tanker Industry

China (FXI) released its key economic data for June—import and export data, auto sales data, and the manufacturing index.

China’s April Trade Data and the Crude Oil Tanker Industry

China, which has the second-largest economy in the world, has a significant impact on the crude tanker industry.

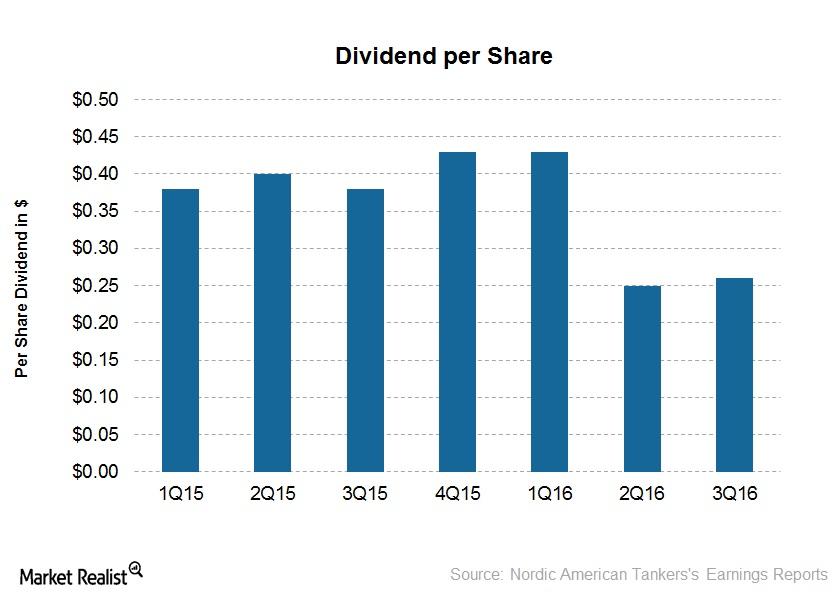

Nordic American Tankers’ Long Dividend History Continued

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.