Which Energy Stocks Are Impacted More by Crude Oil?

On September 12, WTI crude oil (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) active contracts closed at $46.29 per barrel—0.9% above the previous closing price.

Dec. 4 2020, Updated 10:53 a.m. ET

Crude oil

On September 12, 2016, WTI (West Texas Intermediate) crude oil (UWTI) (USO) (OIIL) (USL) (SCO) (DWTI) active contracts closed at $46.29 per barrel—0.9% above the previous closing price. The rise in oil prices coincides with the fall of ~0.3% in the US Dollar Index spot rate. It’s also due to reports indicating a large fall in crude oil stockpiles at Cushing, Oklahoma. The US Dollar Index (UUP) closed at 95.09 on September 12, 2016.

The US Dollar Index fell due to the dovish stance of three Fed officials on September 12, 2016. On September 9, 2016, the president of the Federal Reserve Bank of Boston, Eric Rosengren, expressed support for a gradual hike in the interest rate. On that day, US crude oil October futures fell 3.7% as the US Dollar Index rose 0.3%.

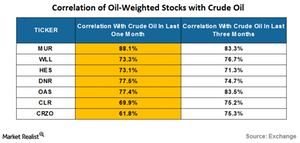

In this series, we’ll take a close look at the correlations between crude oil–weighted stocks and crude oil. We’ll also look at the correlations between natural gas–weighted stocks and natural gas.

Oil-weighted stocks

Let’s look at some of the upstream companies that are part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and operate with a production mix of at least 60% in crude oil. Below are the correlations of these oil-weighted companies with WTI crude oil from August 12 to September 12, 2016. You can also see these in the above table. Oil-weighted stocks that are correlated strongly with crude oil over the last month include:

- Murphy Oil (MUR) – 88.1%

- Whiting Petroleum (WLL) – 73.3%

- Hess (HES) – 73.1%

- Denbury Resources (DNR) – 77.5%

- Oasis Petroleum (OAS) – 77.4%

- Continental Resources (CLR) – 69.9%

- Carrizo Oil & Gas (CRZO) – 61.8%

Oil-weighted stocks that had the lowest correlation with crude oil include the following:

Investors who are bullish on crude oil might use some of the stocks that have a high correlation with crude oil to realign their portfolios.

In the next part of this series, we’ll look at the returns of crude oil–weighted stocks compared to crude oil.