Are US Gasoline Inventories a Pain for Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls to 218.9 MMbbls on September 22–29, 2017.

Oct. 5 2017, Published 10:59 a.m. ET

US gasoline inventories

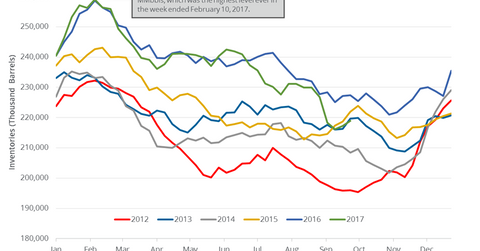

The EIA (U.S. Energy Information Administration) estimates that US gasoline inventories rose by 1.6 MMbbls (million barrels) to 218.9 MMbbls on September 22–29, 2017. Inventories rose 0.8% week-over-week, but have fallen 3.7% or by 8.5 MMbbls from the same period in 2016.

Earlier, a market survey estimated that US gasoline inventories would have risen by 1.1 MMbbls on September 22–29, 2017.

US gasoline (UGA) futures rose 0.96% and closed at $1.58 per gallon on October 4, 2017. Prices rose despite the rise in gasoline inventories. Gasoline and crude oil (UWT) (DWT) (SCO) prices usually move together, but they diverged on October 4, 2017.

WTI crude oil futures are at a two-week low. Lower crude oil (USO) (UCO) prices have a negative impact on oil and gas producers (XES) (RYE) like EOG Resources (EOG), Whiting Petroleum (WLL), Newfield Exploration (NFX), and Energen (EGN). Moves in gasoline prices impact refiners (CRAK) like Alon USA Energy (ALJ) and Northern Tier Energy (NTI).

US gasoline production and demand

The EIA estimates that US gasoline production fell 2,000 bpd (barrels per day) to ~9.8 MMbpd (million barrels per day) on September 22–29, 2017. Production fell 0.1% week-over-week and by 135,000 bpd or 1.3% from the same period in 2016.

US gasoline demand fell by 281,000 bpd to 9.2 MMbpd on September 22–29, 2017. Demand fell 3% week-over-week and by 149,000 bpd or 1.5% from the same period in 2016. The fall in gasoline demand is bearish for gasoline (UGA) and crude oil (USL) (DTO) prices.

Impact of gasoline inventories

US gasoline inventories rose for the second straight week. They’re 2% above the five-year average. It could pressure gasoline prices. However, US gasoline inventories have fallen by 22 MMbbls or 9% in the last 15 weeks. A fall in gasoline inventories could benefit gasoline prices and crude oil prices.

In the next part of this series, we’ll review US distillate inventories for the week ending September 29, 2017.