Crude Oil’s Comeback: Analyzing Oil-Weighted Stocks

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price.

Nov. 20 2020, Updated 1:01 p.m. ET

US crude oil

On August 15, 2016, US crude oil (USO) (OIIL) (USL) (SCO) contracts for September delivery closed at $45.74 per barrel—2.8% above its previous closing price. It’s also 10.7% below its highest level for 2016 of $51.23 per barrel on June 8.

Crude oil prices recovered on the hope that OPEC (Organization of the Petroleum Exporting Countries) will hold a meeting in September to discuss potential solutions to current low prices. Also, Saudi Arabia’s energy minister’s statement hinting at some action by OPEC to support prices and a bullish IEA report last week helped support prices.

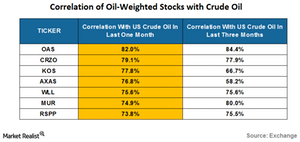

In this series, we’ll take a close look at the correlations between crude oil–weighted stocks and crude oil. We’ll also look at the correlations between natural gas–weighted stocks and natural gas.

Oil-weighted stocks

Let’s look at some of the upstream companies that are part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and operate with a production mix of at least 60% in crude oil. Below are the correlations of these oil-weighted companies with West Texas Intermediate crude oil from July 15 to August 15, 2016. You can also see these in the above table.

Oil-weighted stocks that are correlated strongly with crude oil over the last month include:

- Oasis Petroleum (OAS) – 82%

- Carrizo Oil & Gas (CRZO) – 79.1%

- Kosmos Energy (KOS) – 77.8%

- Abraxas Petroleum (AXAS) – 76.8%

- Whiting Petroleum (WLL) – 75.6%

- Murphy Oil (MUR) – 74.9%

- RSP Permian (RSPP) – 73.8%

Oil-weighted stocks that had the lowest correlation with crude oil include the following:

- Vaalco Energy (EGY) – 17.6%

- Halcón Resources (HK) – 16.5%

Investors who are bullish on crude oil might use some of the stocks that have a high correlation with crude oil to realign their portfolios.

In the next part of this series, we’ll look at the returns of crude oil–weighted stocks compared to crude oil.