RSP Permian Inc

Latest RSP Permian Inc News and Updates

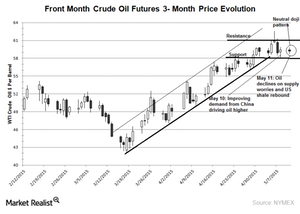

Uncertain Times for the Crude Oil Market: Neutral Doji Pattern

June WTI crude oil futures showed the neutral doji pattern on May 9. Oil prices are swinging due to the frequent change in supply and demand dynamics.

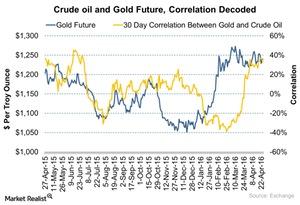

Gold and Crude Oil: How Does the Correlation Work?

Gold (GLD) can be considered an indicator of economic fear and inflation expectations. Driven by these fears, gold gains during equity market turmoil.

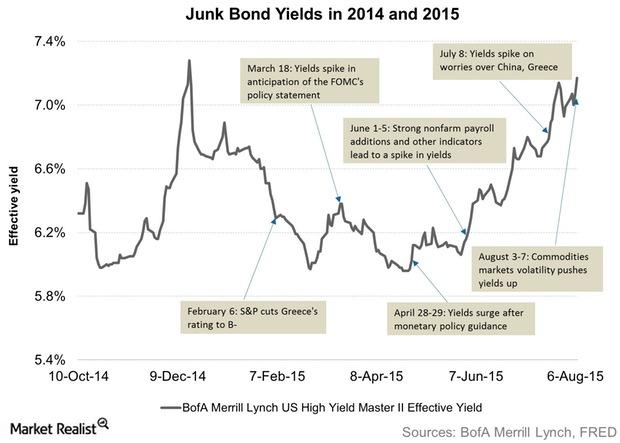

First Data was the Highest Junk Bond Issuer: Week to August 7

Junk bond issuance activity rose in the week ending August 7 after two weeks of subdued activity. The broad market conditions improved.