Why Goldman Sachs Revised Its Crude Oil Price Forecast

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages.

Nov. 20 2020, Updated 4:57 p.m. ET

Crude oil prices could rise

Barclays projects that strong demand from India and China will benefit crude oil prices. The International Energy Agency estimates that the crude oil supply and demand gap could decline faster than expected in 2016. Read Non-OPEC Crude Oil Production Impacts Crude Oil Prices and Will the Crude Oil Supply and Demand Gap Narrow by Early 2017? to learn more.

Crude oil price forecast

Goldman Sachs (GS) forecast that Brent crude oil prices could test $50 per barrel in 2H16 due to recent supply outages. For more on supply outages, read the first part of the series. Previously, Goldman Sachs estimated that crude oil prices could average between $40 and $45 per barrel in 2H16. Wall Street Journal surveys show that Brent crude oil prices will average $39.25 per barrel in 2Q16. The prices will rise to $42.30 in 3Q16. World Bank reported that Brent crude oil prices could average around $41 per barrel in 2016—compared to its previous estimates of $37 per barrel.

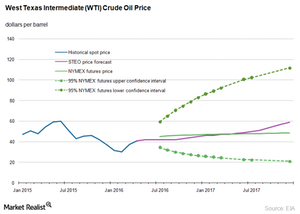

The EIA (U.S. Energy Information Administration) released its STEO (Short-Term Energy Outlook) report on May 10, 2016. It estimates that Brent crude oil prices will average $40.52 per barrel in 2016 and $50.65 per barrel in 2017. Likewise, US benchmark WTI (West Texas Intermediate) crude oil prices are expected to average $40.32 per barrel and $50.65 per barrel during the same period, respectively. In the April STEO report, the EIA estimated that Brent and WTI crude oil prices will average ~$34 per barrel in 2016 and ~$40 per barrel in 2017.

The rise and fall in crude oil prices impact oil producers like Linn Energy (LINN), Stone Energy (SGY), W&T Offshore (WTI), Denbury Resources (DNR), and Carrizo Oil & Gas (CRZO). It also impacts ETFs and ETNs like the ProShares UltraShort Bloomberg Crude Oil ETF (SCO), the iShares US Oil Equipment & Services ETF (IEZ), the PowerShares DWA Energy Momentum (PXI), and the United States Brent Oil (BNO).

For related analysis, visit Market Realist’s Energy and Power page.