XLE Outperforms USO Last Week

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. XLE tracks a diverse group of 45 of the largest American energy stocks in the S&P 500 Index (SPX).

May 3 2021, Updated 11:11 a.m. ET

The Energy Select Sector SPDR ETF

The Energy Select Sector SPDR ETF (XLE) fell 0.66% in the week ended September 11. This ETF tracks a diverse group of ~45 of the largest American energy stocks that constitute the S&P 500 Index (SPX).

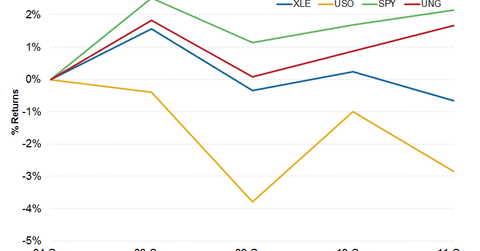

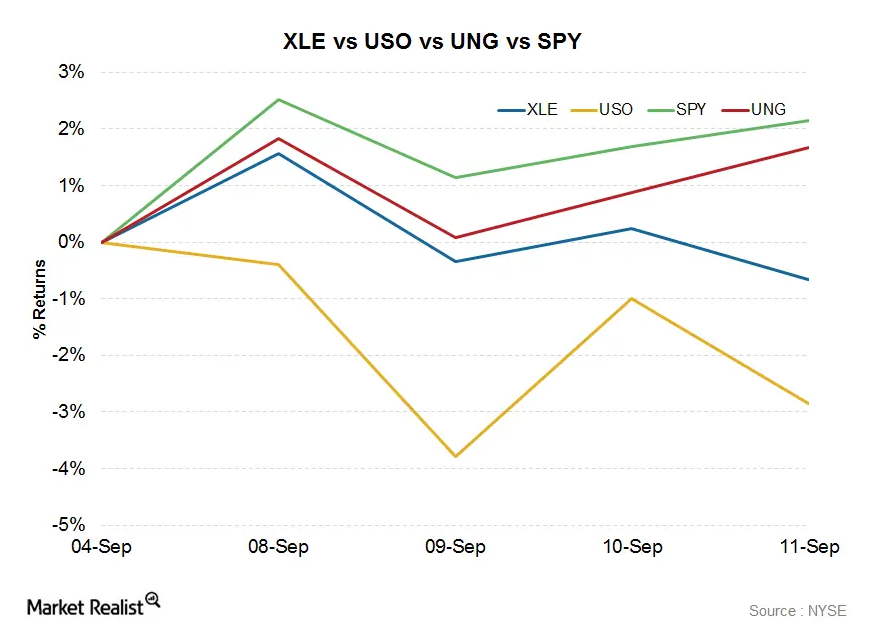

Comparing performances

In comparison, the broad market SPDR S&P 500 ETF (SPY) rose 2.15%. The United States Oil ETF (USO) was the biggest loser among our comparable group of securities that we’re looking at in this article for the week ended September 11. It fell 2.85%.

In contrast, the United States Natural Gas ETF (UNG) rose 1.67%. USO and UNG track movements in prompt WTI (West Texas Intermediate) crude oil and Henry Hub natural gas futures prices, respectively. The fall in USO was thanks to the fall in crude oil prices, which fell 3.08% between September 4 and September 11. On the other hand, natural gas prices rose 1.43% in the same period.

Apart from upstream energy companies, lower crude oil prices are also negative for MLPs such as MarkWest Energy Partners (MWE).

About XLE

The Energy Select Sector SPDR ETF (XLE) has exposure to many types of energy companies with different exposures to energy prices. For example, XLE holds the following:

- upstream oil and gas companies like ConocoPhillips (COP)

- midstream energy companies like Kinder Morgan (KMI)

- downstream or refining companies like Valero Energy (VLO)

- oilfield equipment and services companies like Schlumberger (SLB)

- integrated energy companies like Chevron (CVX)

XLE offers safer, low cost, diversified exposure to energy prices. However, investors should also note that XLE is a market-weighted index ETF. Its top five securities constitute 44% of its weight, with Exxon Mobil (XOM) and CVX alone constituting ~28%.

In the week ended September 11, XLE’s biggest losers included Williams Companies (WMB) and Hess (HES), which fell ~8.94% and 7.75%, respectively, between September 4 and September 11. They were followed by Murphy Oil (MUR), which fell 6.87% in the same period. These companies together constitute ~5.5% of XLE.