Why Did Crude Oil Prices Rise?

On February 9, 2017, US crude oil futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session.

Nov. 20 2020, Updated 5:11 p.m. ET

US crude oil prices

On February 9, 2017, US crude oil (USO) (OIIL) (USL) (SCO) futures contracts for March delivery closed at $53.00 per barrel—an ~1.3% rise compared to the previous trading session. The rise in gasoline demand led the upside in crude oil prices.

From February 2, 2017, to February 9, 2017, US crude oil (USL) (OIIL) futures contracts for March fell 1%. Lately, the oil market has been concerned about rising US oil production pressuring oil prices.

Natural gas prices

Natural gas (UNG) March futures fell ~1.4% from February 2, 2017, to February 9, 2017. On February 9, 2017, natural gas active futures rose 0.5% due to the fall in natural gas inventories. Earlier in the week, higher temperatures had a negative impact on natural gas prices.

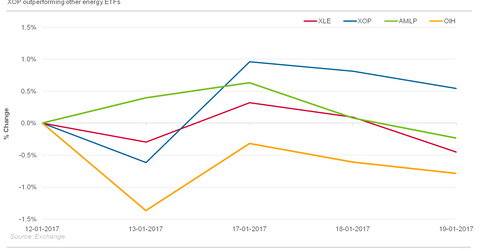

Performances of energy ETFs

Here’s how some energy ETFs performed from February 2, 2017, to February 9, 2017:

Understanding ETF performances

The performances of energy ETFs such as XLE, XOP, AMLP, and OIH correspond better to the fall in oil prices.

Sentiments related to natural gas and crude oil (SCO) also impact other ETFs including the ProShares Ultra Oil & Gas (DIG), the PowerShares DWA Energy Momentum ETF (PXI), the Vanguard Energy ETF (VDE), the iShares US Energy (IYE), and the Fidelity MSCI Energy ETF (FENY).

In the next part of this series, we’ll analyze the price performance of the United States Oil ETF (USO).