US Gasoline Inventories Could Threaten Crude Oil Prices

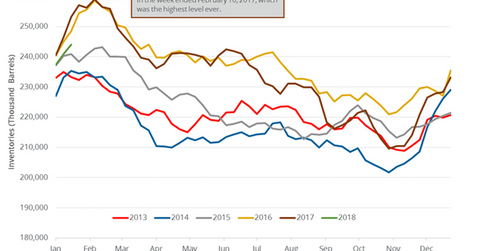

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018.

Jan. 25 2018, Published 8:03 a.m. ET

Weekly US gasoline inventories

According to the EIA, US gasoline inventories increased by 3.1 MMbbls (million barrels) to 244 MMbbls on January 12–19, 2018. Inventories increased 1.3% week-over-week but declined by 9.2 MMbbls or 3.6% YoY (year-over-year).

Analysts estimated that US gasoline inventories would have increased by 2.5 MMbbls on January 12–19, 2018. Gasoline futures rose 0.4% to $1.91 per gallon on January 24, 2018. US crude oil (DWT) (USO) and gasoline futures (UGA) moved together on the same day.

US crude oil (UWT) (UCO) prices are at a three-year high, which favors energy companies (RYE) (PXI) like SM Energy (SM), Hess (HES), Schlumberger (SLB), and Laredo Petroleum (LPI).

US gasoline (UGA) prices are near a three-year high, which favors US refining (CRAK) companies like Holly Frontier (HFC), Marathon Petroleum (MPC), and Valero (VLO).

US gasoline production and demand

US gasoline production decreased by 352,000 bpd (barrels per day) to 9,358,000 bpd on January 12–19, 2018, according to the EIA. Production decreased 3.6% week-over-week but increased by 533,000 bpd or 6% YoY (year-over-year).

US gasoline demand increased by 29,000 bpd to 8,697,000 bpd on January 12–19, 2018. The demand increased by 658,000 bpd or 8.2% YoY. The increase in gasoline demand is bullish for gasoline and oil (USO) prices.

Impact

US gasoline inventories increased for the eleventh consecutive week. Inventories increased by 34.5 MMbbls or 16.5% during this period. If the momentum continues in 2018, it could pressure gasoline (UGA) and oil (UCO) prices.

US gasoline inventories are ~0.8% above their five-year average. If the difference rises, it’s a bearish sign for gasoline and oil (SCO) prices.

Next, we’ll discuss US distillate inventories.