Analyzing Saudi Arabia’s Crude Oil Production Cut Strategy

A Reuters survey estimated that Saudi Arabia’s crude oil production fell by 30,000 bpd (barrels per day) to 10,000,000 bpd in November 2017.

Dec. 7 2017, Updated 11:10 a.m. ET

Crude oil futures

January US crude oil futures (OIL) (UCO) contracts rose 0.1% to $56.02 per barrel at 1:22 AM EST on December 7, 2017. Prices rose due to short covering. However, oil prices are near a three-week low. Lower oil (DBO) prices have a negative impact on energy producers (RYE) like Laredo Petroleum (LPI), Oasis Petroleum (OAS), Cobalt International Energy (CIE), and W&T Offshore (WTI).

Likewise, E-mini S&P 500 (SPY) futures contracts for December 2017 delivery rose 0.19% to 2,634.25 at 1:22 AM on December 7, 2017.

Saudi Arabia’s crude oil production

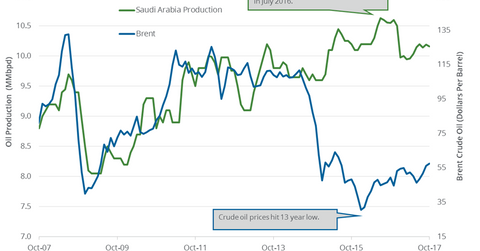

Saudi Arabia is OPEC’s largest oil producer. A Reuters survey estimated that Saudi Arabia’s crude oil production fell by 30,000 bpd (barrels per day) to 10,000,000 bpd in November 2017—compared to the previous month. Production fell due to current production cuts. On November 30, 2017, OPEC extended the output cuts until December 2018.

Oil (DBO) (USL) prices have risen ~30% since the lows in June 2017, partially due to current production cuts. Higher oil prices support oil producers (IEZ) (PXI) and will also be crucial in helping transform Saudi Arabia’s economy.

Saudi Arabia raises crude oil prices to Asian importers

Saudi Aramco is Saudi Arabia’s largest state-owned oil company. It has raised its prices on all the crude oil grades to Asian importers for January 2018 contracts. The prices are at the highest level for Saudi Arabia since September 2014. The price rise indicates that Saudi Arabia is succeeding in its production cuts plans. However, US crude oil exports have doubled from a year ago. US crude oil exports to Asia have been rising. Asia is a big market for Russia and Saudi Arabia. Any increase in oil prices from Saudi Arabia could push Asian importers to import more oil from the US.

Impact

On December 4, 2017, Saudi Arabia stated that OPEC would have a closer look at the oil market conditions in June 2018. It would help OPEC decide on a smooth exit strategy from the current output cuts. After OPEC’s deal expires, Russia and OPEC would scale up production. Any increase in global supplies would weigh on oil (USO) (BNO) prices.

Next, we’ll cover US oil inventories and refinery crude oil demand.