Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

Dec. 20 2017, Updated 10:00 a.m. ET

Crude oil futures

February WTI (West Texas Intermediate) crude oil (UWT) (USO) futures contracts rose 0.3% and were trading at $57.7 per barrel at 1:17 AM EST on December 20, 2017. Prices increased due to the API’s (American Petroleum Institute) bullish crude oil inventory report. For more on oil prices, read Part 1 of this series.

The iShares US Oil Equipment & Services ETF (IEZ) rose 0.4% to 33.7 on December 19, 2017. March E-Mini S&P 500 (SPY) futures contracts rose 0.3% to 2,691 at 1:17 AM EST on December 20, 2017.

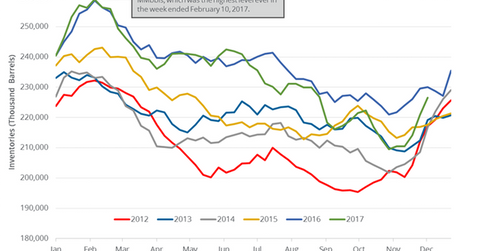

API’s gasoline inventories

On December 19, 2017, the API released its crude oil inventory report. It reported that US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017. Analysts expected that US gasoline inventories could have risen by 2.2 MMbbls during the same period. Any rise in gasoline inventories is bearish for gasoline and oil (USL) prices.

The massive rise in gasoline inventories pressured oil prices in the last few weeks. Lower oil (DWT) prices have a negative impact on energy producers’ (VDE) (PXI) earnings like BP (BP), W&T Offshore (WTI), Northern Oil and Gas (NOG), and Sanchez Energy (SN).

API’s distillate inventories

The API added that US distillate inventories fell by 2.85 MMbbls on December 8–15, 2017. The market expected that US distillate inventories could have fallen by 1.3 MMbbls during the same period. Any fall in distillate inventories is bullish for diesel and oil (USO) prices.

Next, we’ll discuss how Iran’s crude oil production impacts oil prices.